Access Restricted for EU Residents

You are attempting to access a website operated by an entity not regulated in the EU. Products and services on this website do not comply with EU laws or ESMA investor-protection standards.

As an EU resident, you cannot proceed to the offshore website.

Please continue on the EU-regulated website to ensure full regulatory protection.

Wednesday Jan 14 2026 07:26

15 min

Moving average indicator: The moving average is one of the most widely used technical analysis tools in trading and investing.

Start investing in 2026: It helps traders identify trends and potential reversals by smoothing out price data over a specified period. This article will delve into the various types of moving averages, their uses, advantages and disadvantages, and the best indicators used in conjunction with moving averages.

1.1 What is a Moving Average?

A moving average is a statistical calculation that analyzes data points by creating averages from various subsets of the complete dataset. In the context of financial markets, it represents the average price of an asset over a specific number of periods, providing insights into trends and potential price movements.

1.2 Why Use Moving Averages?

Moving averages serve several critical purposes in technical analysis:

(1) Trend Identification

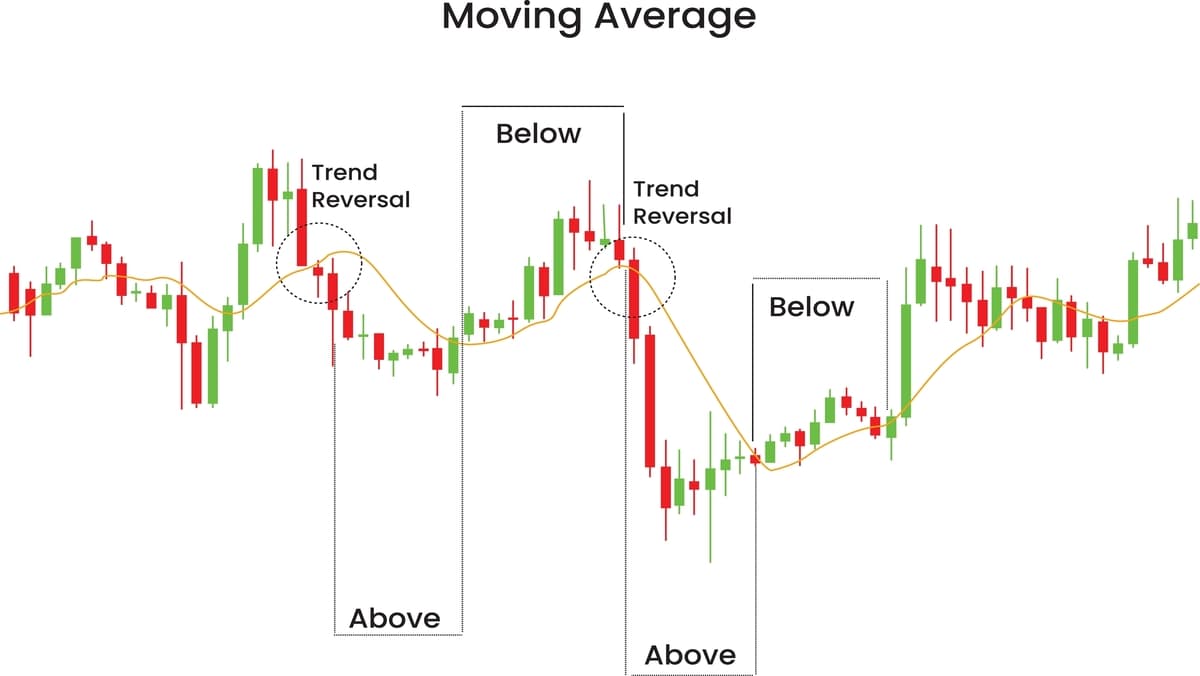

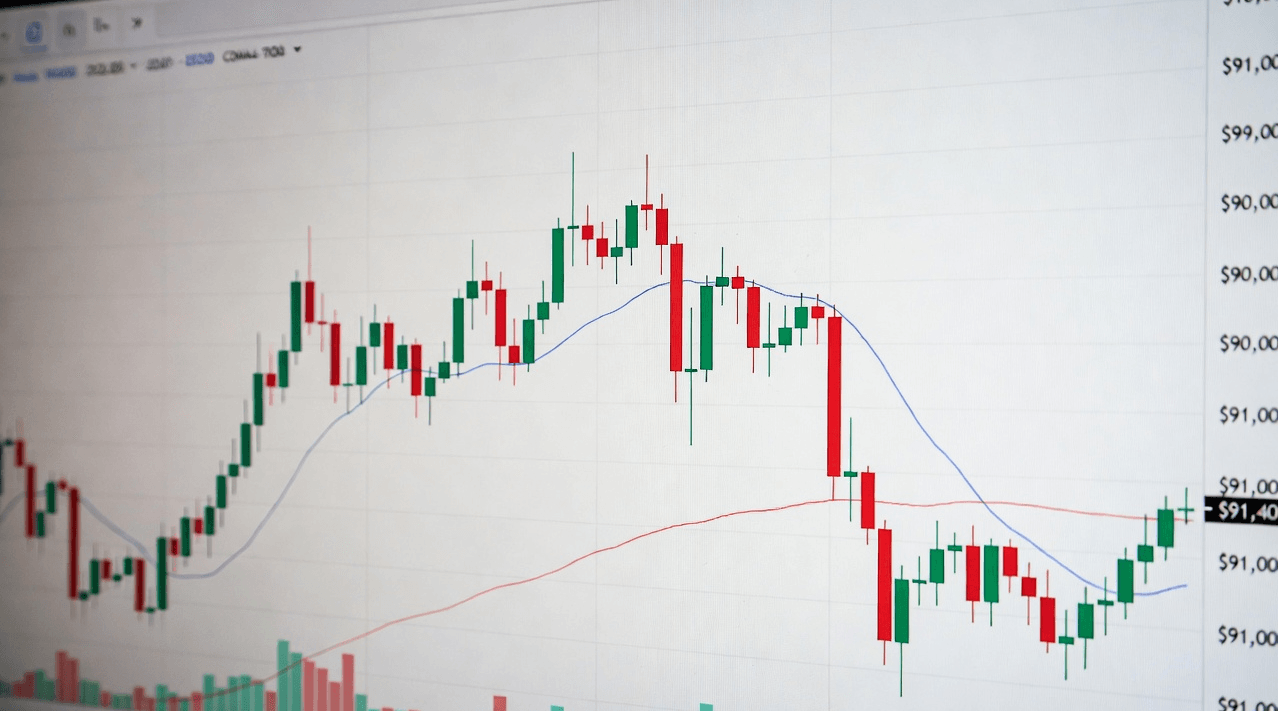

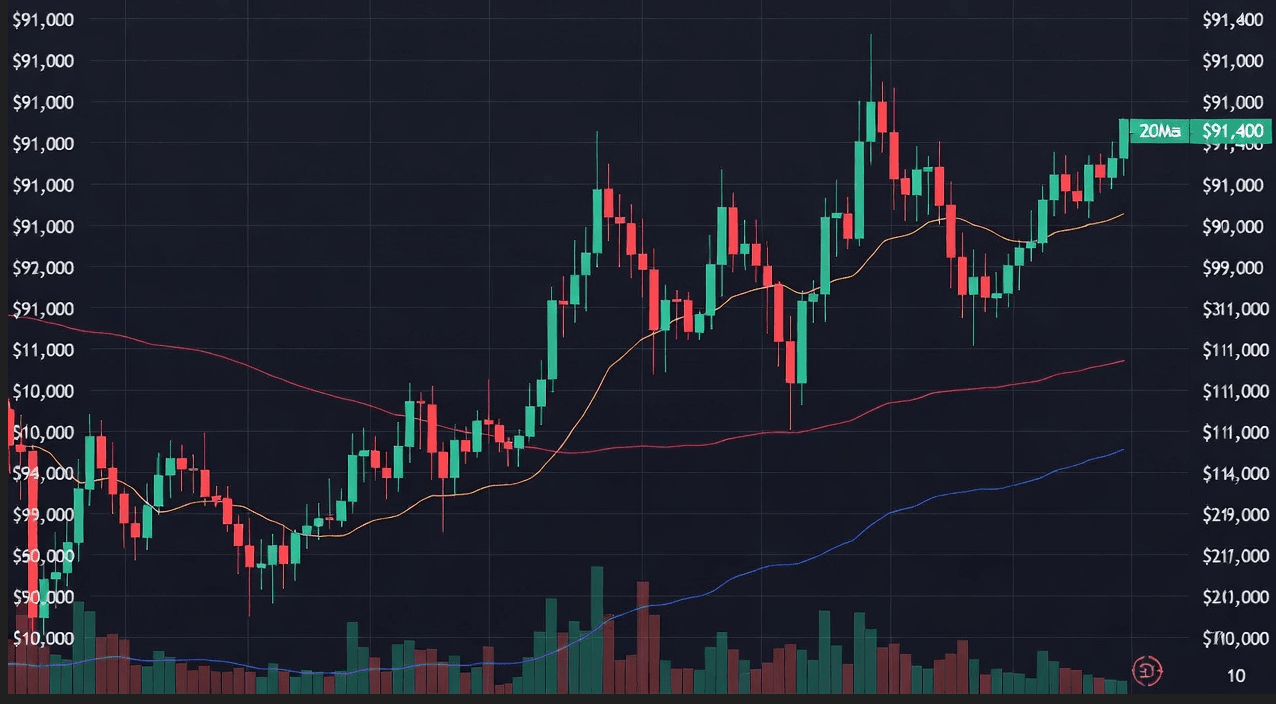

One of the primary uses of moving averages is to identify the prevailing trend in an asset's price. A moving average calculates the average price over a specified period, and by plotting it on a price chart, observers can easily see whether an asset is in an uptrend, downtrend, or sideways movement. For instance, if the price is consistently above the moving average, it indicates a bullish trend, while prices below suggest a bearish trend.

(2) Smoothing Price Data

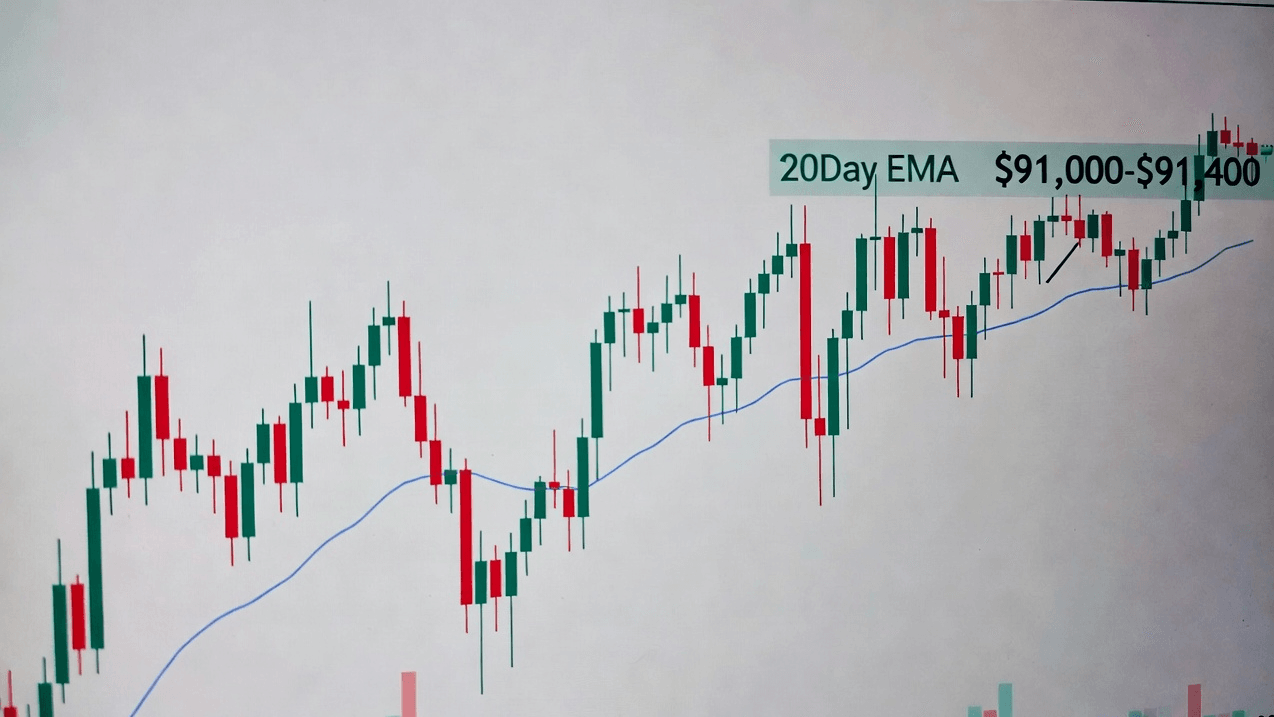

Financial markets can be volatile, displaying rapid price changes within short periods. Moving averages help to smooth out these fluctuations by filtering out noise in the data. This smoothing effect allows traders to focus on the broader trend rather than getting caught up in daily price volatility. For example, a 50-day moving average will provide a clearer picture of the asset's performance over time than daily price charts might reveal.

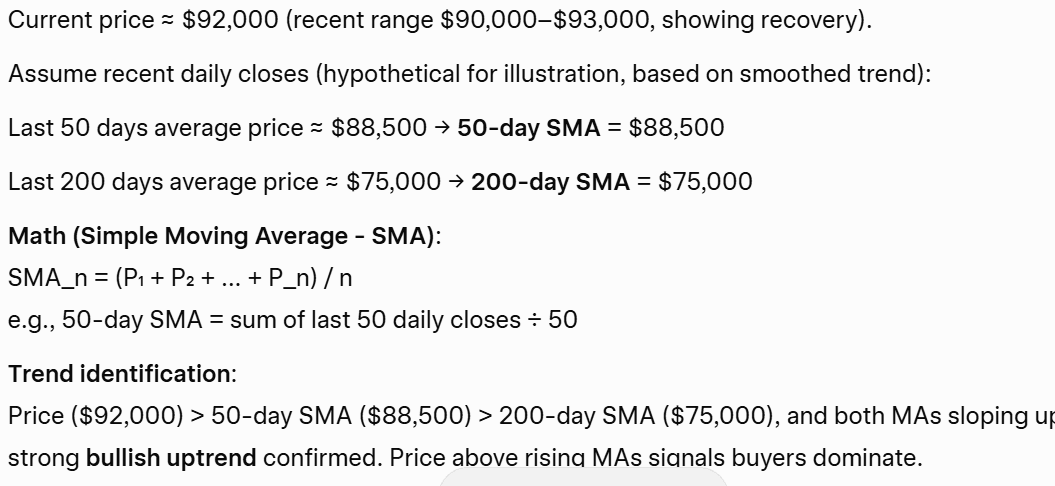

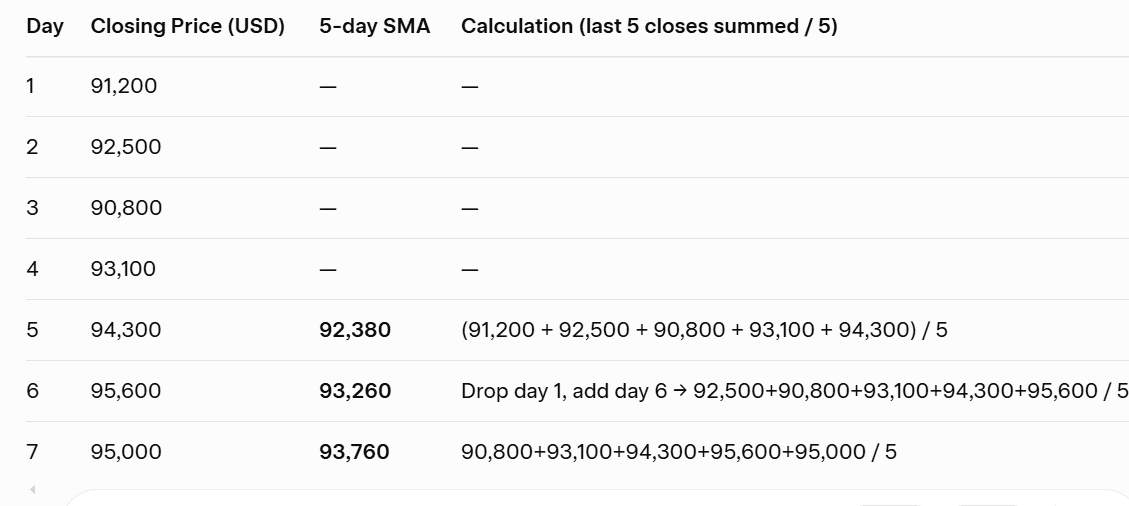

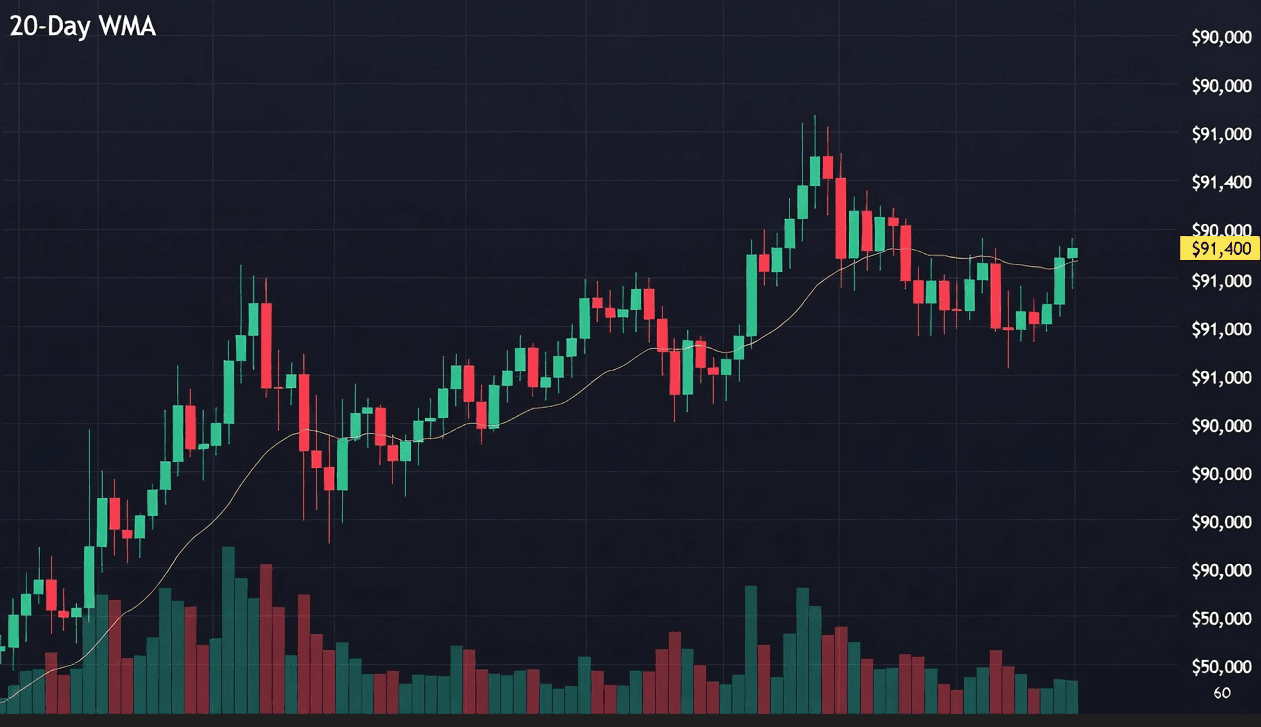

Here's a brief real-world-style example of moving averages smoothing price data, using approximate recent Bitcoin (BTC-USD) daily closing prices around early January 2026 (based on market levels near $92,000–$96,000 as of mid-January 2026).

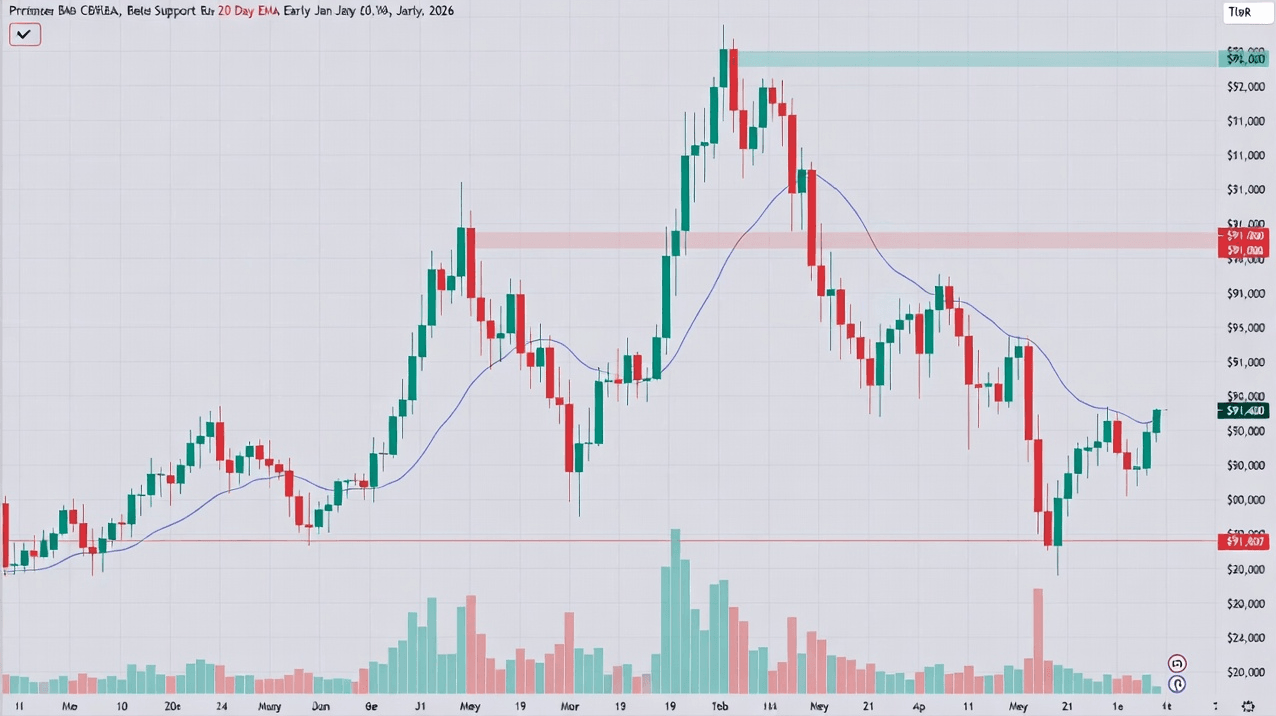

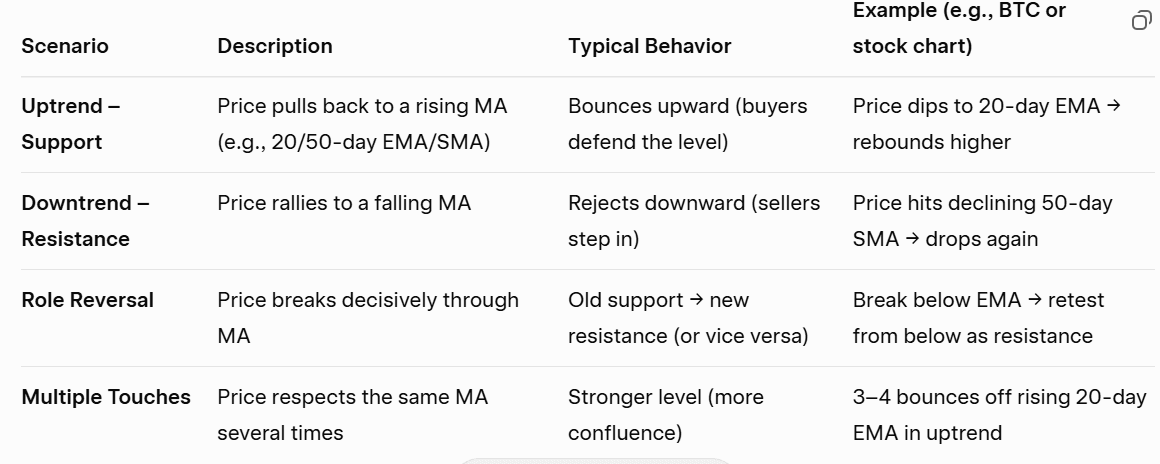

(3) Support and Resistance Levels

Moving averages often act as dynamic support and resistance levels. Traders often watch for the price to bounce off a moving average, indicating a potential buying or selling opportunity.

A moving average can provide a level where buyers are more likely to enter the market (support) or sellers may decide to sell (resistance). For example, in a bullish market, a declining moving average may serve as a support level that price bounces off, reinforcing a buy decision.

(4) Signal Generation

Moving averages can generate trading signals when different MAs cross each other. One of the most popular strategies is the "crossover" technique, where a shorter-term MA crosses above a longer-term MA (bullish signal) or below it (bearish signal).

For instance, the golden cross occurs when a 50-day moving average crosses above the 200-day moving average, signaling a potential rise in price. Conversely, the death cross is observed when a shorter-term average moves below a longer-term average, indicating a potential decline.

(5) Mitigating Emotional Decision-Making

Trading can evoke strong emotions, often leading to impulsive decisions based on fear or greed. Moving averages help mitigate this emotional aspect by providing a systematic approach to decision-making based on historical price data. By relying on concrete signals generated by moving averages, traders can foster a more disciplined trading strategy.

(6) Customization and Flexibility

Traders can customize moving averages to suit their strategies. Different time frames—such as short-term (e.g., 10-day, 20-day) or long-term (e.g., 100-day, 200-day)—can be used depending on individual trading styles. For instance, short-term moving averages may benefit day traders looking for quick profits, while long-term averages might suit investors with a buy-and-hold strategy.

(7) Integration with Other Indicators

Moving averages can also be effectively integrated with other technical indicators to enhance analysis. For example, combining moving averages with momentum indicators, like the Relative Strength Index (RSI), can provide a more comprehensive view of market conditions and improve trading decisions.

1.3 Types of Moving Averages

There are three primary types of moving averages:

Simple Moving Average (SMA)

Exponential Moving Average (EMA)

Weighted Moving Average (WMA)

Each type has its unique characteristics and applications.

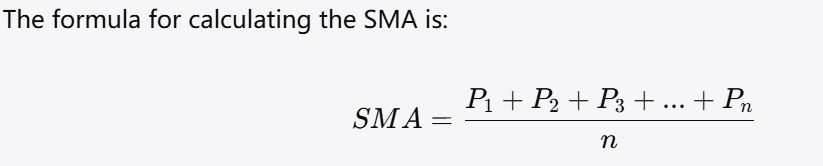

2.1 Definition

The Simple Moving Average (SMA) calculates the arithmetic mean of a set number of price points over a specific period. For instance, a 10-day SMA averages the closing prices of the last ten days.

2.2 Calculation

2.3 Advantages of SMA

Simplicity: The formula is straightforward and easy for traders to calculate or understand.

Consistency: The SMA provides consistent signals, which can be beneficial for long-term trend analysis.

Less Sensitive to Price Fluctuations: Compared to EMAs, SMAs are less impacted by sudden price changes.

2.4 Disadvantages of SMA

Lagging Indicator: SMAs can be slow to react to sudden price changes, leading to potential missed trading opportunities.

Less Responsive: In volatile markets, the SMA may not accurately represent current price dynamics.

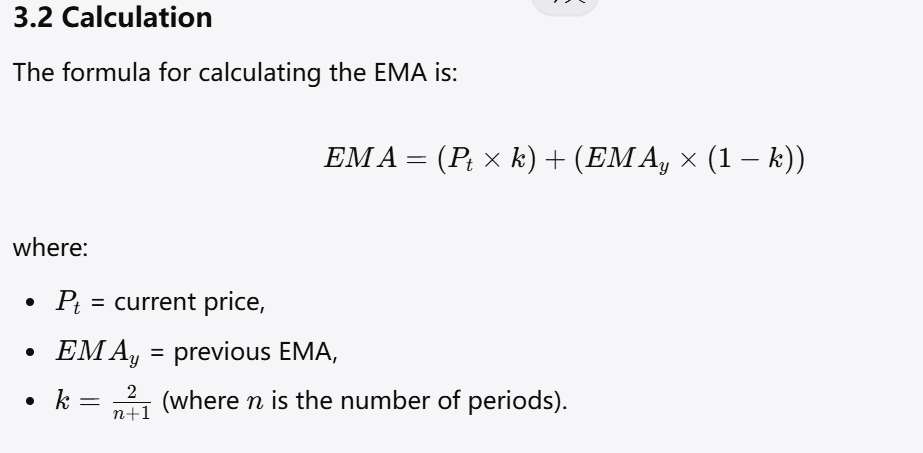

3.1 Definition

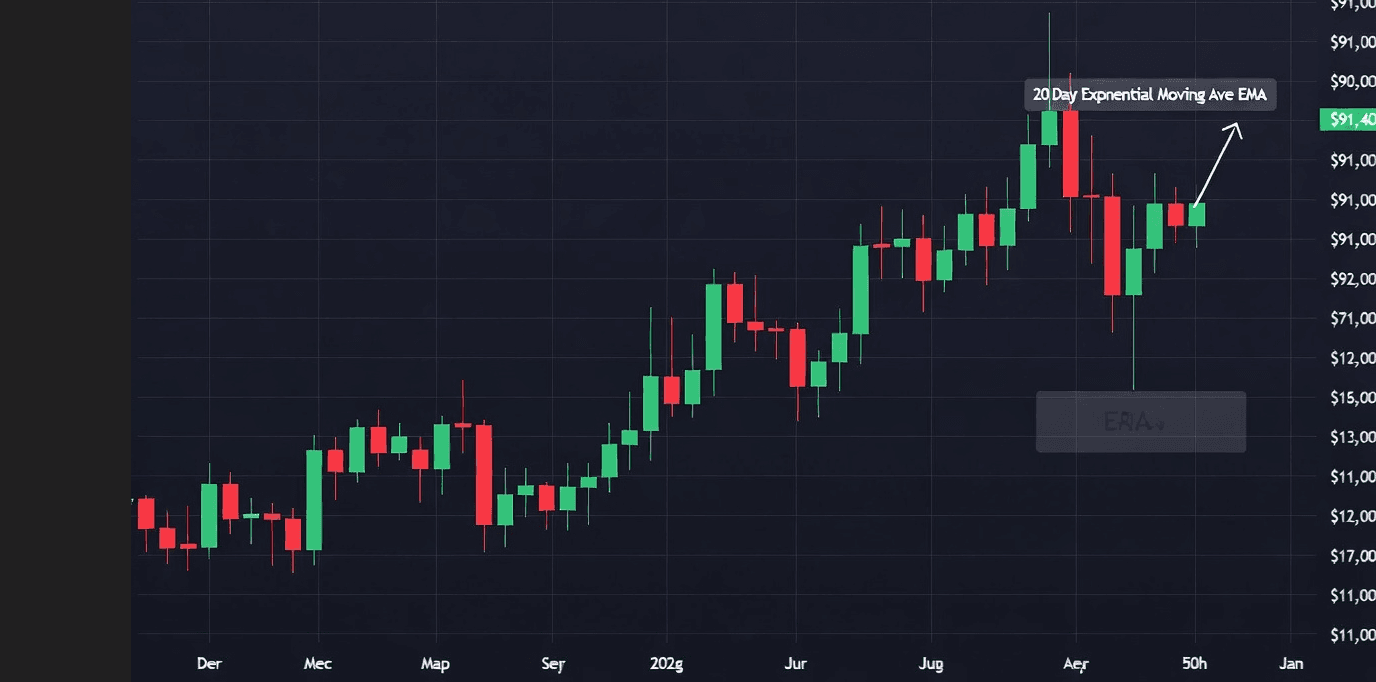

The Exponential Moving Average (EMA) gives more weight to recent prices, making it more reactive to new information compared to the SMA.

3.3 Advantages of EMA

Responsiveness: EMAs react more quickly to price changes than SMAs, making them more suitable for short-term trading.

Better for Identifying Trends: EMAs often identify trends earlier, which can result in better entry and exit points.

3.4 Disadvantages of EMA

Greater Sensitivity to Price Changes: EMAs may give false signals in choppy markets due to their responsiveness.

Complexity: The calculation is more complex than that of the SMA, which can make it less appealing for some traders.

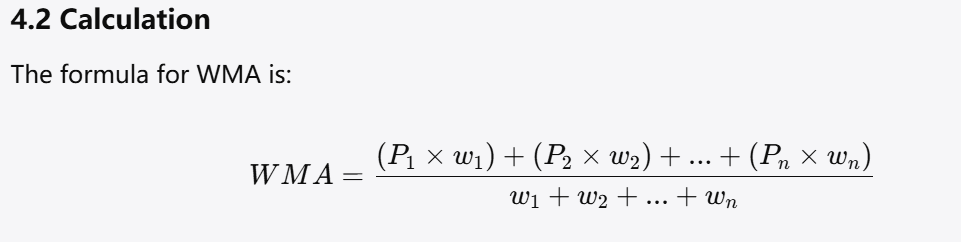

4.1 Definition

The Weighted Moving Average (WMA) assigns different weights to price points, emphasizing the most recent data more than older data.

4.3 Advantages of WMA

Flexibility: Traders can customize weightings based on their trading strategies and preferences.

More Accurate Reflection of Current Trends: WMA can provide a more accurate picture of ongoing price trends than SMAs.

4.4 Disadvantages of WMA

Complexity in Weight Assignment: Deciding how to weight the prices can be subjective and complex.

Still Lagging: Though it is more responsive than SMA, the WMA can still lag in rapidly changing markets.

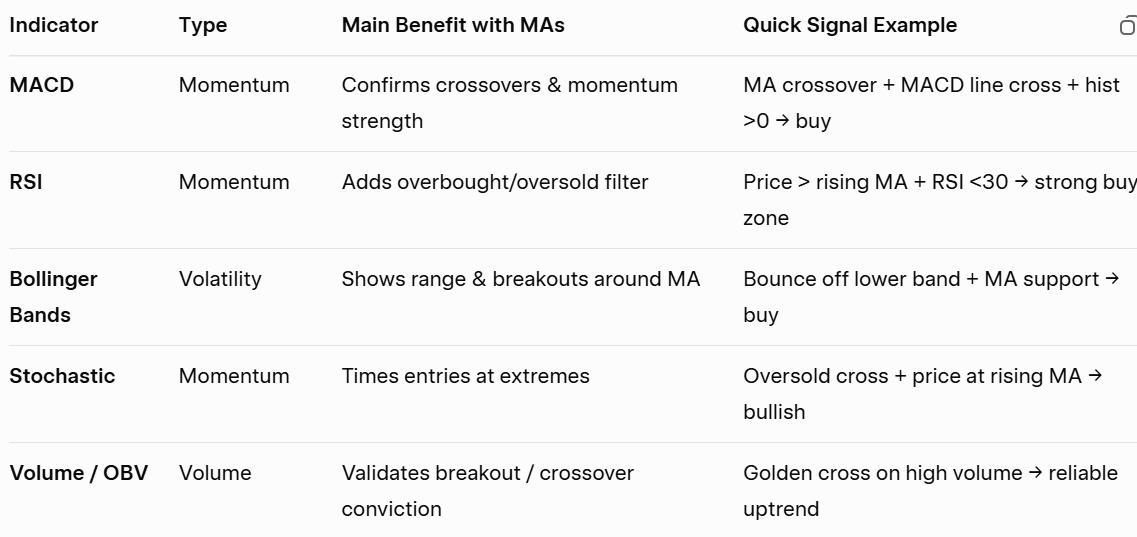

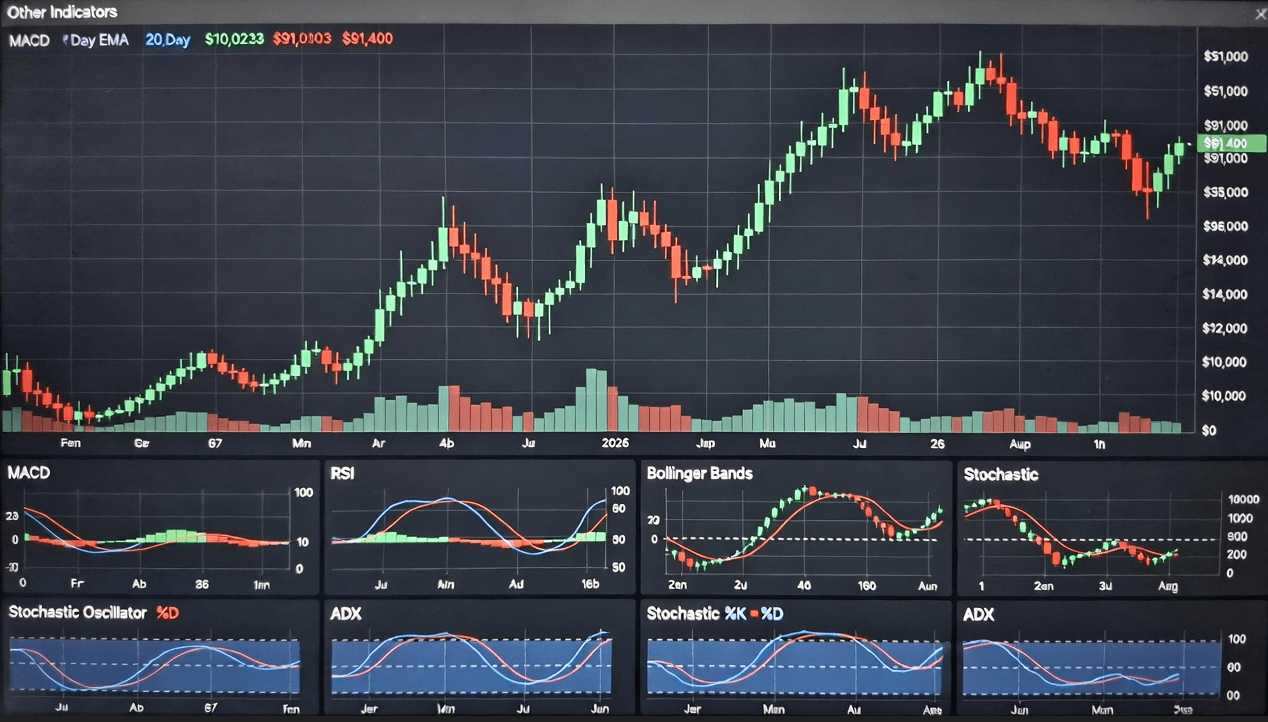

When using moving averages, traders often combine them with other technical indicators to enhance decision-making. Here are some of the best indicators to pair with moving averages:

5.1 Relative Strength Index (RSI)

Overview

The Relative Strength Index (RSI) measures the speed and change of price movements. It ranges from 0 to 100 and is typically used to identify overbought or oversold conditions in an asset.

Best Practices

Use with Moving Averages: Combine RSI with moving averages to determine whether a trend is gaining momentum or losing strength. For example, an RSI above 70 may indicate an overbought condition, while an RSI below 30 may indicate an oversold condition.

Divergence Check: Look for divergences between the RSI and price movement; for instance, if prices are making higher highs while the RSI is making lower highs, this could signal a potential reversal.

5.2 Moving Average Convergence Divergence (MACD)

Overview

The MACD is a trend-following momentum indicator that shows the relationship between two EMAs, typically the 12-period EMA and the 26-period EMA. It includes a signal line, which is usually a 9-period EMA of the MACD line.

Best Practices

Signal Crosses: Use MACD to identify potential buy/sell signals. A MACD line crossing above the signal line may indicate a buying opportunity, while crossing below may signal a selling opportunity.

Histogram for Strength: The histogram represents the distance between the MACD line and the signal line, helping traders visualize the momentum of the trend.

5.3 Bollinger Bands

Overview

Bollinger Bands consist of a middle band (usually an SMA) and two outer bands that represent standard deviations away from the middle band. They are used to gauge volatility and price levels.

Best Practices

Volatility Assessment: When prices touch or breach the outer bands, it may indicate overbought or oversold conditions. Traders can use this information alongside moving averages to make informed decisions.

Trend Confirmation: If the price is above the upper band and moving averages indicate an uptrend, it might signal a strong bullish trend.

5.4 Stochastic Oscillator

Overview

The Stochastic Oscillator compares an asset’s closing price to its price range over a specific period. This momentum indicator ranges from 0 to 100 and helps identify overbought or oversold conditions.

Best Practices

Confirmation of Signals: Use the Stochastic Oscillator with moving averages to confirm trend strength. An overbought condition in conjunction with a moving average signal can indicate a potential reversal.

Divergence Indicator: Look for divergences where the stochastic indicator moves differently than price, which may indicate a weakening trend.

6.1 Bull Markets

In bull markets, moving averages can help identify upward trends. Traders may choose to use:

Shorter Moving Averages: Such as the 10-day or 20-day EMA for more immediate insights. A price consistent above the moving average can signify strong bullish momentum.

Crossovers: When a shorter moving average crosses above a longer moving average, it is often considered a bullish signal.

6.2 Bear Markets

In bear markets, moving averages can help identify downtrends and potential reversal points:

Sell Signals: A shorter moving average crossing below a longer moving average can indicate a bearish trend.

Resistance Levels: The moving average can serve as a resistance level where the price may struggle to break above, helping traders pinpoint entry and exit points.

6.3 Sideways Markets

In sideways or consolidating markets, moving averages can help identify potential breakouts:

Whipsaw Risk: Traders should be cautious of false signals during such periods as moving averages can lead to whipsaw trades, where prices frequently cross above and below the moving averages without a clear trend.

Trade Ranges: Combining moving averages with oscillators like the RSI can assist in determining overbought and oversold conditions, enhancing decision-making.

7.1 Time Frame Selection

The effectiveness of moving averages can vary based on the chosen time frame. Shorter time frames (daily or weekly) provide quick responses but may generate more noise. In contrast, longer time frames (monthly) can provide clearer trend signals but may lag in responsiveness. Traders should select a time frame that aligns with their trading strategy:

Day Traders: May opt for shorter averages (5-10 periods).

Swing Traders: Often use averages from 20 to 50 periods.

Long-Term Investors: May consider averages from 100 to 200 periods.

7.2 Combining Multiple Moving Averages

Using multiple moving averages can help traders gain insights into market momentum and determine the strength of trends:

Golden Cross: Occurs when a shorter-term moving average crosses above a longer-term moving average, signaling a potential bullish trend.

Death Cross: Happens when a shorter moving average crosses below a longer moving average, indicating a possible bearish trend.

7.3 Developing a Trading Strategy

Incorporating moving averages into a trading strategy requires careful consideration of entry and exit signals:

Entry Points: Traders may enter positions when price action aligns with moving average signals and other indicators.

Stop Losses: Position stop-loss orders below moving averages to manage risk while allowing trades to work.

When using moving averages, traders should be aware of common pitfalls:

8.1 Ignoring Market Context

Moving averages are just one tool in a trader’s toolbox. Ignoring overall market context, news, and economic indicators can lead to poor decision-making.

8.2 Over-Reliance on Signals

While moving averages provide valuable insights, relying solely on them without confirming with other indicators might result in missed opportunities or losses.

8.3 Neglecting Trade Management

Failure to apply proper risk management strategies when trading with moving averages can lead to significant losses. Always use stop-loss orders and position sizing strategies.

Moving averages are a powerful tool in technical analysis, providing traders with insights into price trends, potential reversals, and market momentum. Choosing the right type of moving average and its application depends significantly on individual trading strategies and market conditions.

By combining moving averages with complementary indicators like RSI, MACD, and Bollinger Bands, traders can enhance their analysis and decision-making processes. As with any trading tool, understanding the nuances and risks of moving averages is crucial for effective application. With diligence, patience, and a well-structured approach, traders can utilize moving averages to improve their trading performance and achieve their investment goals.

Looking to trade CFDs? Choose Markets.com for a user-friendly platform, competitive spreads, and a wide range of assets. Take control of your trading journey today! Sign up now and unlock the tools and resources you need to succeed in the exciting world of CFDs. Start trading!

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.