Access Restricted for EU Residents

You are attempting to access a website operated by an entity not regulated in the EU. Products and services on this website do not comply with EU laws or ESMA investor-protection standards.

As an EU resident, you cannot proceed to the offshore website.

Please continue on the EU-regulated website to ensure full regulatory protection.

Friday Jan 23 2026 10:12

15 min

S&P 500 trading for beginners: The S&P 500 index is a crucial benchmark for understanding the performance of the U.S. stock market.

Beginner's guide to CFD trading: It includes 500 of the largest publicly traded companies in the U.S. and serves as an important measure of the overall economic health. Trading CFDs (Contracts for Difference) on the S&P 500 offers a valuable opportunity for beginners to engage with this index without the need to own the underlying assets. This guide aims to provide a comprehensive walkthrough for trading S&P 500 CFDs through the Markets.com platform.

Contracts for Difference (CFDs) are financial instruments that allow traders to speculate on the price movement of an asset without actually owning it. When trading a CFD, you enter into an agreement with a broker, agreeing to exchange the difference in price from when you open the contract to when you close it.

The basic premise of CFDs is that traders can speculate on price movements. If you believe the price of the underlying asset will increase, you can buy (go long) the CFD. If you believe the price will decrease, you can sell (go short) the CFD.

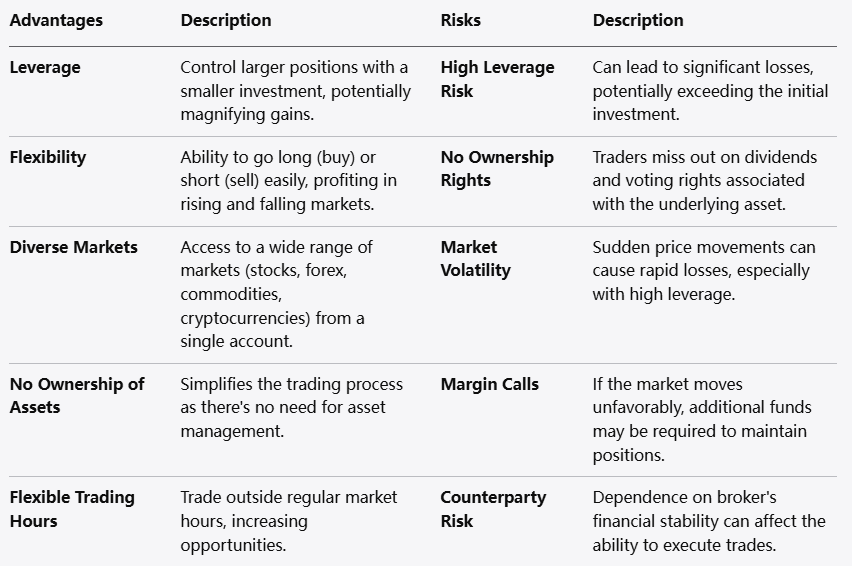

Key Features of CFDs:

Advantages of Trading CFDs

Diversification: CFDs let you trade a wide range of assets including stocks, indices, and commodities through a single platform.

Hedging Options: You can protect existing investments by going short on the index.

Accessibility: Many platforms offer user-friendly interfaces, making it easier for beginners to start trading.

Risks of Trading CFDs

Leverage Risks: While leverage can amplify returns, it also magnifies losses, which could exceed the initial investment.

Market Volatility: Prices can change rapidly, leading to potential losses if trades are not monitored closely.

Counterparty Risk: You're at risk if the broker fails, as you're entering into a contract with them rather than a market exchange.

The S&P 500 is a stock market index that consists of 500 of the largest companies listed on U.S. stock exchanges. It's considered a reliable indicator of the overall performance of the U.S. stock market and economy.

The S&P 500 is a market-capitalization-weighted index, meaning that companies with larger market caps have a greater impact on the index. This is adjusted quarterly, incorporating changes in the market.

Advantages of Trading S&P 500 CFDs

Diversification

Trading S&P 500 CFDs provides exposure to a variety of industries without needing to buy shares of individual companies, which helps in spreading risk.

Flexibility

You can easily go short on the S&P 500, allowing you to profit if the index declines. This flexibility provides opportunities in both rising and falling markets.

Leveraged Trading

CFDs allow traders to use leverage, meaning you can control a more extensive position than your initial deposit. This can amplify potential returns, making it an attractive option for traders looking to maximize their investments.

Access to Global Markets

Markets.com allows you to trade CFDs on the S&P 500 alongside various global indices, offering a wide range of assets to choose from in one platform.

Creating an Account

To begin trading S&P 500 CFDs on Markets.com, you will first need to create an account.

Visit the Website: Go to the Markets.com homepage.

Click on 'Open an Account': Look for the registration button and click it to start the account-creation process.

Fill in Your Information: Provide necessary details, including your name, email address, and phone number.

Verification: You may be required to verify your identity by submitting documentation such as a government-issued ID and proof of address.

Funding Your Account

Once your account is set up, you will need to fund it before you can start trading.

Select a Payment Method: Markets.com typically offers several funding options, including credit/debit cards, bank transfers, and e-wallets.

Deposit Funds: Follow the instructions to deposit an amount of your choosing. Make sure to refer to any minimum deposit requirements.

Navigating the Trading Platform

Once your account is funded, familiarize yourself with the Markets.com trading platform. Key features include:

Market Overview: Access information on different markets, including the S&P 500.

Charts and Analysis Tools: Utilize various charts, indicators, and tools to help in your trading decisions.

Order Types: Learn how to place market orders, limit orders, and stop-loss orders to manage your trading effectively.

Choosing Your Trading Strategy

Developing a trading strategy is crucial for success in trading S&P 500 CFDs. Common strategies include:

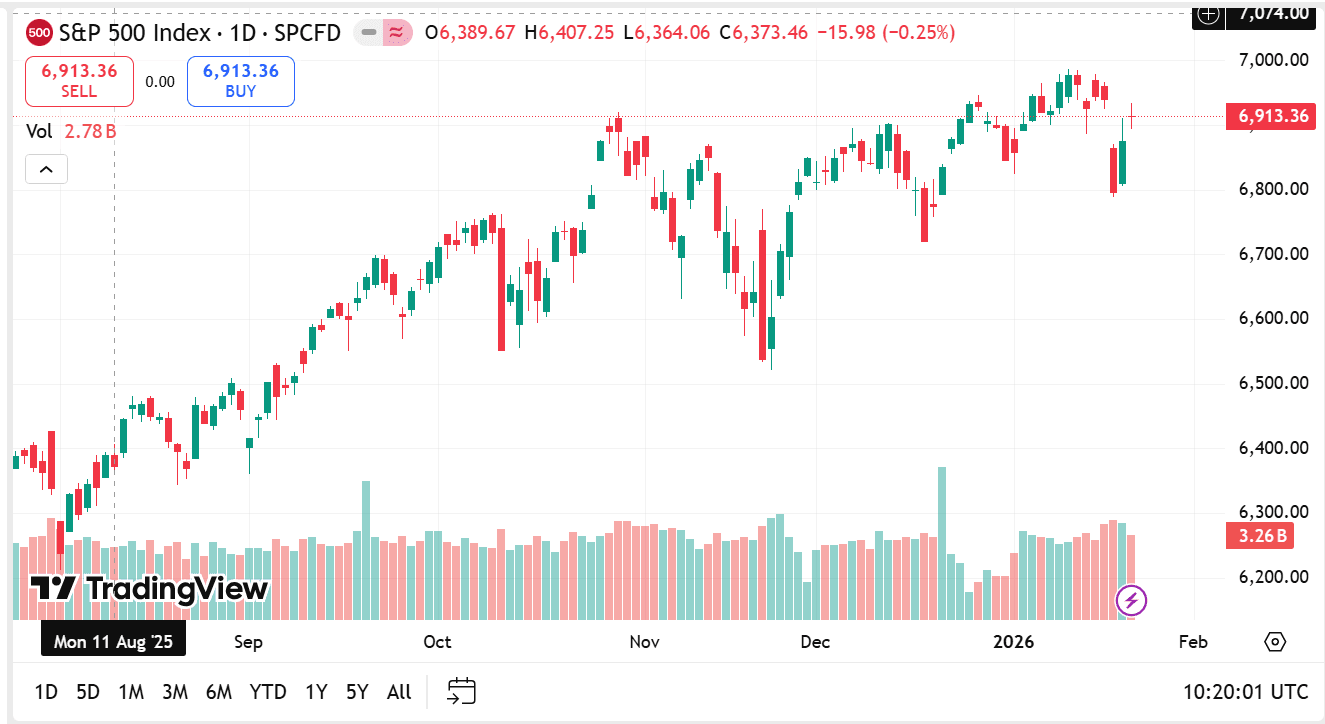

source: tradingview

Analyzing the Market

Before placing trades, it is essential to conduct thorough research and analysis. Key types of analysis include:

Fundamental Analysis: This involves examining economic indicators, earnings reports, and news events that might impact the S&P 500.

Technical Analysis: This focuses on historical price movements and patterns using charts and indicators to forecast future price actions.

Placing Your Trade

When you're ready to make a trade, follow these steps:

Select the S&P 500 from the Market List: Locate the index on the platform.

Choose Your Position: Decide whether to buy (go long) or sell (go short) based on your analysis.

Select the Size of Your Trade: Determine how many contracts you want to trade.

Set Stop-Loss and Take-Profit Levels: Protect your capital by setting stop-loss orders to limit potential losses and take-profit orders to secure gains.

Review and Execute: Double-check your order details, then confirm the trade.

Managing Your Positions

Once you have opened a position, effective management is crucial:

Monitor Market Conditions: Keep an eye on market news and events that may affect the S&P 500.

Adjust Stop-Loss and Take-Profit Orders: As the market moves, consider adjusting your orders to lock in profits or reduce losses.

Exit Strategies: Know when to exit a trade, whether you hit your target, stop-loss, or if market conditions change unexpectedly.

The Importance of Risk Management

Risk management is essential in trading to protect capital and ensure long-term sustainability. Trading without clear risk management can lead to substantial losses, particularly when using leveraged products like CFDs.

Setting Stop-Loss Orders

Utilizing stop-loss orders is an effective way to manage risk. A stop-loss order automatically closes your position when the market price reaches a predetermined level. This can prevent larger losses from developing.

Position Sizing

Determine the size of each trade based on your total account equity and risk tolerance. A common rule is to risk no more than a small percentage of your capital on a single trade, which can help protect your portfolio from significant losses.

Diversification

Though CFD trading allows for easy diversification, ensure that you do not concentrate too much risk in one position or asset. Spreading investments across various indices or asset classes can mitigate potential losses.

Overtrading

One of the most common pitfalls for new traders is overtrading, which can occur due to emotional decision-making or attempting to recoup losses. Stick to your trading plan and avoid impulsive trades.

Lack of Research

Failing to conduct adequate research can lead to poorly informed trading decisions. Always analyze market conditions and relevant news before placing a trade.

Ignoring Risk Management

Neglecting risk management can quickly drain your trading account. Always implement strategies to protect your capital, such as using stop-loss orders and maintaining proper position sizing.

Trading Without a Plan

Having a clear trading plan that outlines your goals, strategies, and risk tolerance is essential for success. Trading without a plan can lead to inconsistency and poor decision-making.

The Role of Economic Indicators

Understanding Economic Indicators

Economic indicators are statistics that reflect the health of the economy and are crucial for traders. Various indicators can impact the movements of the S&P 500, including employment rates, GDP growth, inflation rates, and consumer spending.

Employment Data: Job creation and unemployment rates provide insight into economic growth and consumer spending power.

Inflation Reports: Rising inflation can lead to a tightening of monetary policies, impacting stock valuations.

GDP Growth Rates: A rising GDP often correlates with corporate earnings growth, positively influencing the S&P 500.

Consumer Confidence Index: Higher consumer confidence usually leads to increased spending, benefitting companies within the index.

How Global Events Affect the Market

The S&P 500 is not only influenced by domestic factors but also by global events. International trade agreements, geopolitical tensions, and occurrences like natural disasters can influence market sentiment and index performance.

Monitoring Global News

Keeping up with global news is vital for understanding potential impacts on the S&P 500:

Geopolitical Situations: Political unrest or military conflicts can lead to market uncertainty, potentially affecting investor sentiment negatively.

Trade Deals: Positive or negative shifts in trade agreements affect corporate earnings, especially for companies that rely on international markets.

Continuous Learning

The financial markets are ever-changing, and continuous education is essential. Stay informed about market trends, financial news, and trading strategies.

Utilizing Educational Resources

Many trading platforms, including Markets.com, offer educational resources such as webinars, articles, and tutorials. These can help enhance your trading knowledge:

Webinars and Workshops: Live sessions hosted by experienced traders can provide insights into market trends and trading strategies.

Articles and Blogs: Following reliable sources for market analysis can help you stay up-to-date with industry developments.

Demo Accounts: Before committing real money, consider using a demo account. This allows you to practice trading with virtual funds and gain valuable experience.

Technical Analysis Tools

Many trading platforms offer technical analysis tools like charts and indicators that can help you make informed trading decisions. Learning to read these can enhance your trading strategies significantly.

Chart Patterns

Identifying chart patterns can help traders forecast future price movements. Look for well-known patterns such as:

Head and Shoulders: Indicates a reversal pattern, signaling potential changes in market direction.

Triangles: Suggests that the market is consolidating and can predict a continuation or reversal break when fully formed.

Support and Resistance Levels: Recognizing where prices frequently pull back or break through can help set your entry and exit points.

Economic Calendars

Tracking economic calendars can provide insights into significant upcoming events that might affect market conditions. Key publications like employment figures, GDP numbers, and central bank meetings can significantly impact the S&P 500.

Building a Tracing Community

Importance of Networking at Traders

Engaging with other traders can be beneficial for sharing ideas and strategies. Many trading platforms offer forums or community features where you can connect with others.

Finding a Mentor

If possible, find a mentor who can provide guidance based on their experience. A mentor can help accelerate your learning and provide valuable insights that can be difficult to acquire alone.

Trading the S&P 500 CFDs through Markets.com offers an accessible way for beginners to enter the financial markets. By understanding the fundamentals of CFDs, the S&P 500 index, and how to effectively utilize the Markets.com platform, new traders can embark on their trading journey with greater confidence.

A solid foundation in trading strategies, robust risk management, and a clear focus on continuous education will enhance the likelihood of success. The financial market is filled with opportunities, and with the right approach, you can navigate this complex landscape and potentially achieve your financial goals. Trading requires diligence, patience, and a willingness to learn, making these traits essential for any aspiring trader. By arming yourself with the right tools, strategies, and information, you are better positioned to make informed decisions that align with your trading objectives.

Looking to trade S&P 500 CFDs? Choose Markets.com for a user-friendly platform, competitive spreads, and a wide range of assets. Take control of your trading journey today! Sign up now and unlock the tools and resources you need to succeed in the exciting world of CFDs. Start trading!

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.