Access Restricted for EU Residents

You are attempting to access a website operated by an entity not regulated in the EU. Products and services on this website do not comply with EU laws or ESMA investor-protection standards.

As an EU resident, you cannot proceed to the offshore website.

Please continue on the EU-regulated website to ensure full regulatory protection.

Thursday Dec 4 2025 08:04

14 min

What are the most traded indices: Trading indices CFDs offers traders a powerful way to speculate on the performance of stock market indices without the need to own the underlying assets.

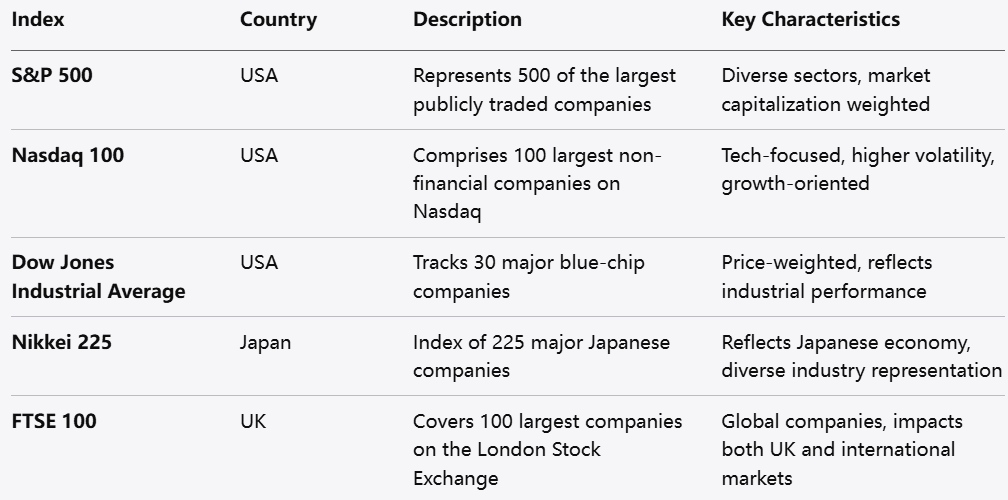

CFD trading guide: Through this guide, we will explore the most traded indices, including the S&P 500, Nasdaq 100, Dow Jones Industrial Average, Nikkei 225, FTSE 100, NIFTY 50, and Germany 40 (DAX). We will also delve into how to trade these indices effectively with Markets.com, including tools, strategies, risk management, and best practices.

What Are Indices CFDs?

Indices CFDs are financial derivatives that allow traders to speculate on the future price movements of stock market indices. When engaging in indices trading, you are effectively betting on whether the index will rise or fall without actually buying the stocks that compose the index. This offers a convenient and efficient way to gain exposure to a wide market segment with a single trade.

Benefits of Trading Indices CFDs

Diversification: Instead of investing in individual stocks, trading indices allows you to spread risk across numerous companies. For example, a trader investing in the S&P 500 gains exposure to 500 different companies, which mitigates the impact of poor performance from any single stock.

1. S&P 500 (USA)

Overview

The S&P 500 index tracks 500 of the largest publicly traded companies in the U.S. It is widely regarded as a strong indicator of the U.S. equity market.

Key Characteristics

Broad Sector Representation: The S&P 500 encompasses various sectors, including technology, healthcare, financials, and consumer goods. This broad representation makes it a reliable gauge of economic health.

Market Capitalization Weighted: This means that larger companies have a more significant impact on the index's performance than smaller ones. This structure often leads to growth-oriented indices reflecting the performance of larger, more stable companies.

2. Nasdaq 100 (USA)

Overview

The Nasdaq 100 includes 100 of the largest non-financial companies listed on the Nasdaq stock exchange, heavily dominated by technology.

Key Characteristics

Technology Focus: Major players like Apple, Microsoft, and Alphabet are part of this index, making it particularly sensitive to technological advancements and trends.

Volatility: Given its concentration in tech stocks, the Nasdaq 100 can experience higher volatility compared to more diversified indices like the S&P 500.

3. Dow Jones Industrial Average (USA)

Overview

The Dow Jones Industrial Average, often referred to simply as "the Dow," is one of the oldest and most recognized stock indices in America. It comprises 30 blue-chip companies.

Key Characteristics

Price Weighted: Unlike the S&P 500, the Dow is calculated based on the stock prices of its members, which can sometimes lead to distortions in how the index reflects broader market movements.

Stable Companies: The Dow includes some of the most established and well-respected companies in the U.S., making it a less volatile option in comparison to the Nasdaq 100.

4. Nikkei 225 (Japan)

Overview

The Nikkei 225 is Japan's leading stock market index, composed of 225 large companies listed on the Tokyo Stock Exchange.

Key Characteristics

Economy Indicator: The Nikkei serves as a gauge of Japan's economic health and business trends, often responding sharply to changes in domestic and international political or economic environments.

Diverse Industry Representation: It includes companies across various sectors, from automobiles to electronics, reflecting the broader Japanese economy.

5. FTSE 100 (UK)

Overview

The FTSE 100 is the index covering the 100 largest companies listed on the London Stock Exchange and serves as a primary indicator of British market health.

Key Characteristics

Global Company Influence: Many companies included in the FTSE 100 are multinational corporations, which means their performance is often influenced by global economic factors rather than just the UK economy.

Sector Variety: The index includes a mix of sectors, such as financial services, pharmaceuticals, and consumer goods.

6. NIFTY 50 (India)

Overview

The NIFTY 50 is the benchmark stock index for the National Stock Exchange of India, representing 50 of the largest and most liquid companies in the Indian market.

Key Characteristics

Market Captivity: Comprising major sectors of the Indian economy, the NIFTY represents roughly two-thirds of the total market capitalization of the National Stock Exchange.

Dynamic Growth: India’s rapidly growing economy and expanding corporate sector make the NIFTY an essential index for monitoring the country’s economic trajectory.

7. Germany 40 (DAX)

Overview

The DAX index tracks the 40 largest publicly traded companies in Germany on the Frankfurt Stock Exchange, making it a crucial indicator of German and European market health.

The S&P 500 is a crucial U.S. stock market index that consists of 500 of the largest publicly traded companies, serving as a benchmark for the overall health of the U.S. economy. It spans various sectors, including technology, healthcare, finance, and consumer goods, reflecting the wide-ranging landscape of the economy.

Operating on a market capitalization-weighted basis, larger companies exert a more significant impact on the index's performance. This extensive coverage makes the S&P 500 popular among both institutional and individual investors, providing a reliable indicator of long-term equity market trends.

The Nasdaq 100 includes 100 of the largest non-financial companies on the Nasdaq stock exchange, with a strong focus on technology giants like Apple, Microsoft, and Amazon. Known for its growth potential, this index often exhibits higher volatility due to its concentration in tech stocks.

The Dow Jones Industrial Average, one of the oldest indices, consists of 30 blue-chip companies and is price-weighted, which can skew its representation of broader market trends. Globally, the Nikkei 225 represents major firms in Japan, while the FTSE 100 reflects the largest companies on the London Stock Exchange, impacting both the UK and global markets.

India’s NIFTY 50 serves as a critical market indicator with 50 leading firms, and Germany’s DAX tracks the 40 largest companies in Europe, each providing valuable insights into their respective economies.

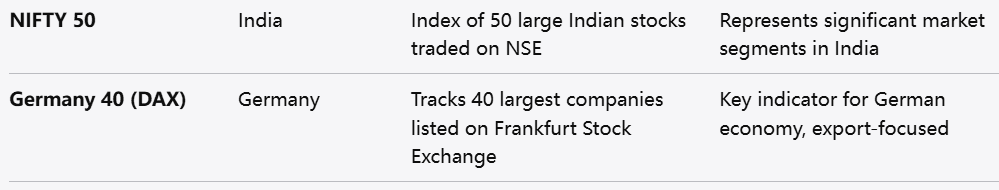

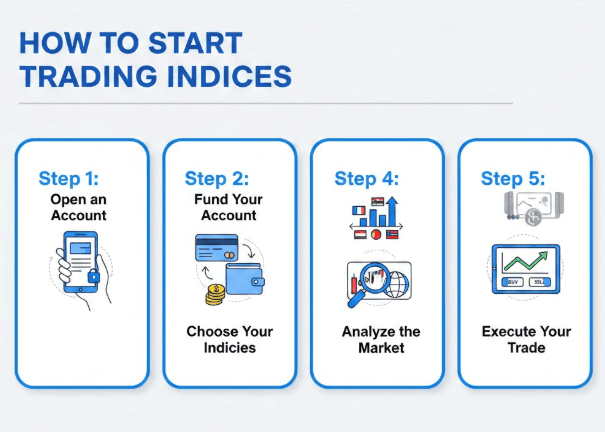

To trade indices CFDs on Markets.com, follow these steps:

Step 1: Open an Account

Begin by registering for an account on Markets.com. Provide your personal information and complete the identity verification process to ensure compliance with regulations.

Step 2: Fund Your Account

Once your account is set up, deposit funds using one of the various payment methods available, such as credit/debit cards or bank transfers. Choose the method that suits you best.

Step 3: Choose Your Indices

Browse the available indices CFDs on the Markets.com platform. Select from popular indices such as the S&P 500, Nasdaq 100, Dow Jones, and others, depending on your trading strategy.

Step 4: Analyze the Market

Conduct thorough research to analyze market conditions, using both technical and fundamental analysis. Utilize the platform’s trading tools, including charts and economic calendars, to make informed decisions.

Step 5: Execute Your Trade

When you are ready, place your trade by specifying the direction (buy or sell) and the position size. Set your stop-loss and take-profit orders to manage risk, and monitor your trade for any adjustments needed.

Markets.com provides a user-friendly interface designed to cater to both novice and experienced traders. Here are some of the platform's notable features:

1. Wide Range of Instruments

Markets.com offers access to a diverse array of trading instruments, including indices, stocks, commodities, forex, and cryptocurrencies. This wide selection allows traders to diversify their portfolios and capitalize on various market opportunities.

2. User-Friendly Trading Platform

The platform is designed for both beginners and experienced traders, featuring an intuitive interface and advanced trading tools. Users can easily navigate charts, utilize technical analysis tools, and implement trading strategies effectively.

3. Educational Resources

Markets.com provides a wealth of educational materials, including webinars, tutorials, and market analysis. These resources help traders enhance their knowledge and skills, making informed decisions in the financial markets.

4. Competitive Trading Conditions

With tight spreads, leverage options, and various account types, Markets.com offers competitive trading conditions. This can lead to better profitability potential and flexibility for different trading strategies.

1. Fundamental Analysis

Understanding the broader economic landscape is essential for trading indices. Keep an eye on key economic indicators—like GDP growth, employment figures, and consumer confidence—that can affect market sentiment and index performance.

2. Technical Analysis

Utilizing technical charts and indicators can provide insights into price trends and potential trading opportunities. Commonly used indicators in indices trading include moving averages, Relative Strength Index (RSI), and MACD.

3. Trend Following

Identifying and following trends can be beneficial when trading indices. Traders often look for upward or downward momentum, entering or exiting trades based on the direction of that momentum.

4. Risk Management

Implementing robust risk management strategies is critical for long-term success. This includes setting stop-loss orders to limit potential losses and determining position sizes based on your risk tolerance.

Understanding Leverage

Leverage can amplify both gains and losses, so it’s essential to understand its ramifications fully. While it may enhance potential returns, it also increases the risk of losing more than your initial investment. Use leverage wisely and always consider your risk tolerance.

Emotional Discipline

Fear and greed can lead to irrational trading decisions. Maintaining emotional discipline is crucial for successful trading. Avoid making impulsive trades based on emotions; instead, stick to your trading plan and strategy.

Continuous Learning

The financial markets are ever-changing, and successful traders stay informed about market trends, economic developments, and trading strategies. Engage in continuous learning through educational resources, webinars, and market news.

Trading indices CFDs presents a compelling method to access a variety of markets with reduced individual stock risk. With platforms like Markets.com offering access to major indices such as the S&P 500, Nasdaq 100, Dow Jones Industrial Average, Nikkei 225, FTSE 100, NIFTY 50, and the Germany 40 (DAX), traders are poised to capitalize on market movements while employing a diversified approach.

By understanding the characteristics of each index, embracing effective trading strategies, and applying sound risk management practices, individuals can navigate the complexities of indices trading effectively. The ever-evolving financial landscape brings both challenges and opportunities, making it vital for traders to remain adaptable and informed in their trading endeavors.

As the world continues to transition through economic cycles, staying abreast of global events, central bank policies, and market dynamics will be essential in harnessing the full potential of indices trading. With the right tools and knowledge, traders can position themselves in the dynamic world of indices CFDs confidently.

Looking to trade indices CFDs? Choose Markets.com for a user-friendly platform, competitive spreads, and a wide range of assets. Take control of your trading journey today! Sign up now and unlock the tools and resources you need to succeed in the exciting world of CFDs. Start trading!

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.