Access Restricted for EU Residents

You are attempting to access a website operated by an entity not regulated in the EU. Products and services on this website do not comply with EU laws or ESMA investor-protection standards.

As an EU resident, you cannot proceed to the offshore website.

Please continue on the EU-regulated website to ensure full regulatory protection.

Wednesday Jan 28 2026 09:56

15 min

What is a stochastic indicator: The stochastic indicator, also known as the stochastic oscillator, is a widely used momentum indicator in technical analysis.

Start investing in 2026: This guide will delve deep into the stochastic indicator, exploring its formula, functionality, and how traders can effectively utilize it in their trading strategies, along with insights on combining it with other indicators like the RSI.

This guide is meticulously structured to offer you a thorough understanding of the stochastic indicator. From basic concepts to advanced trading techniques, each section builds upon the previous discussions, helping you develop a comprehensive view of the stochastic oscillator and its practical application in trading scenarios.

At its core, the stochastic oscillator operates under the premise that market prices reflect momentum. In an uptrending market, prices typically close near their highs, while in a downtrending market, they close near their lows. This oscillation provides traders with vital clues about potential market reversals and sustainability of trends.

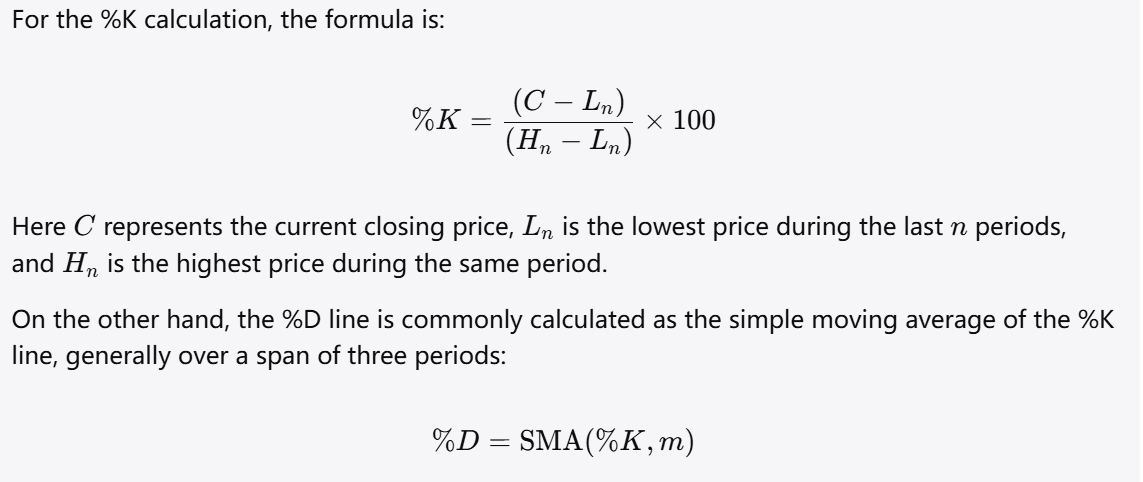

The stochastic oscillator consists of two primary components: the %K line and the %D line. The %K line represents the primary calculation, while the %D line is the moving average of %K, providing more stability and smoothing out short-term fluctuations. Understanding these components is essential for interpreting market signals correctly.

The stochastic indicator's value ranges from zero to 100, with readings above 80 indicating an overbought condition and readings below 20 indicating an oversold condition. While these levels are commonly used thresholds, savvy traders often adapt them based on the asset and prevailing market conditions.

Defining the Stochastic Indicator Formula

To comprehend how the stochastic oscillator operates, it's vital to familiarize yourself with its calculation. The core formula for the stochastic oscillator includes the current price relative to the high and low prices over the specified period.

By harnessing these formulas, traders can derive noticeable trends and make informed decisions that align with their trading strategies.

The power of the stochastic indicator lies in its ability to capture momentum shifts. When the market is strong and moving upward, the closing prices will tend to cluster near the highest prices; conversely, in declining markets, closing prices will cluster near the lowest prices. This relationship allows traders to gauge the strength of trends and anticipate potential pivot points.

The strength of this indicator manifests prominently in its ability to signal overbought and oversold conditions. An overbought stochastic reading can suggest that the asset is due for a price correction, while an oversold reading can indicate a potential upward movement.

Additionally, traders should consider the context in which the stochastic indicator is signaling. For example, in a strong long-term uptrend, an overbought reading may not prompt selling but could signal a continuation of that upward trend for an extended period. Awareness of broader market conditions ensures traders interpret signals more accurately.

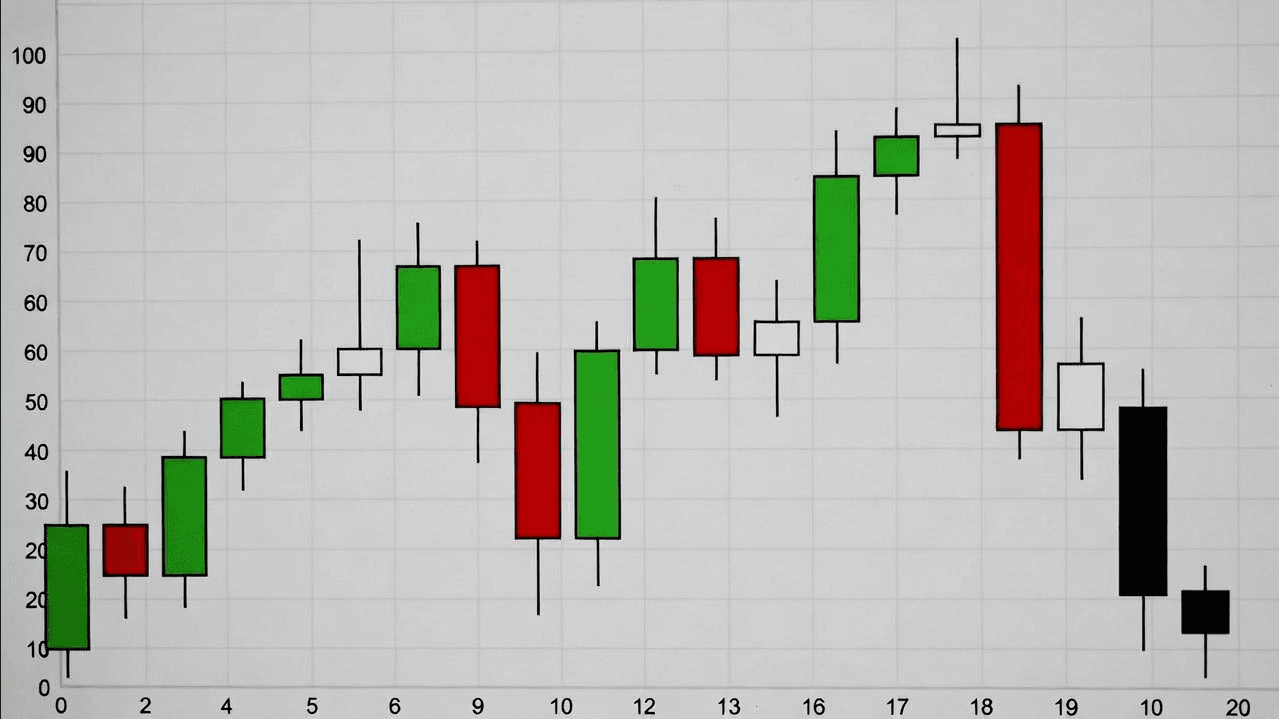

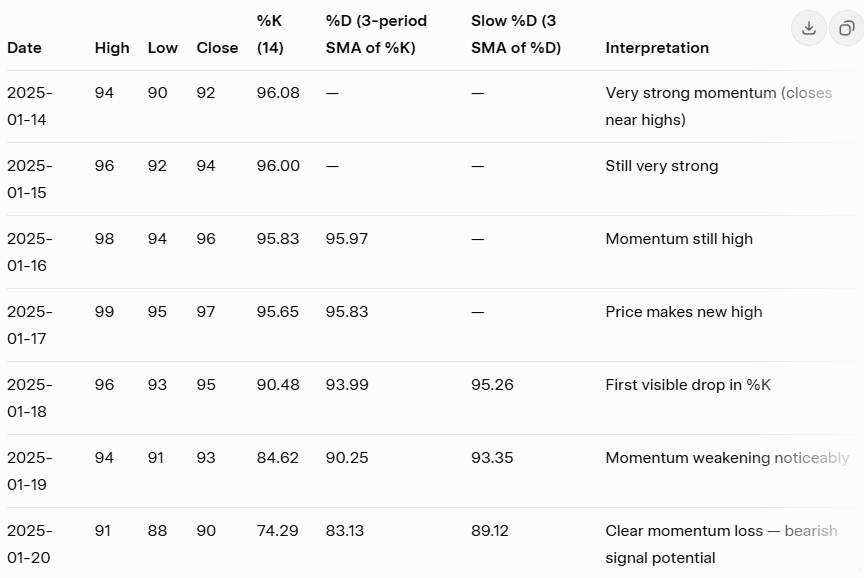

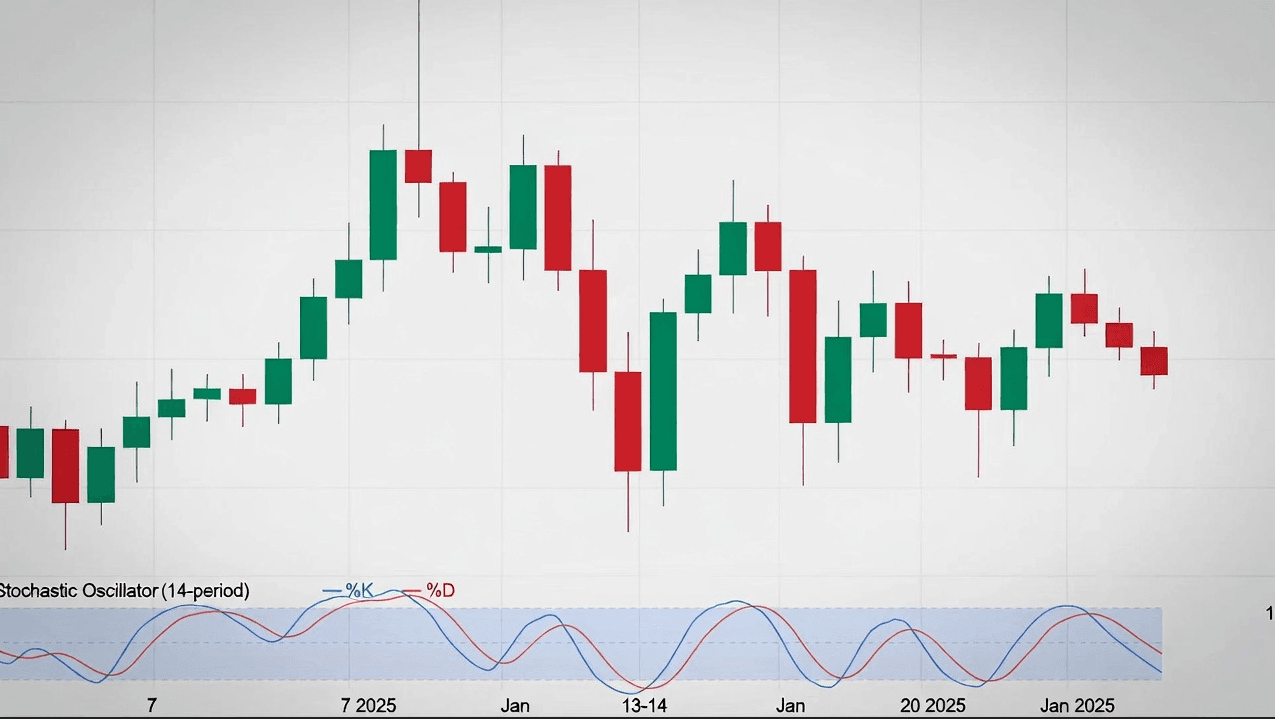

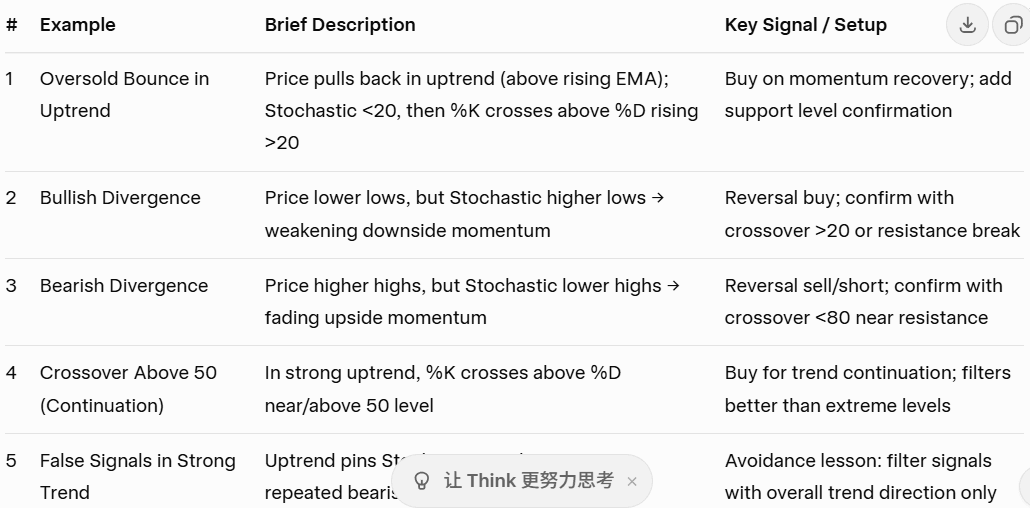

Here is a realistic 20-day price series showing a strong uptrend that gradually loses momentum in the final days (smaller gains, closes pulling back from highs, larger upper shadows). This is a classic setup for bearish divergence on the Stochastic.

Key observations:

Price peaks at 97 (new high on Jan 17), then starts declining → yet the trend was still called "up" by many until the last 2–3 days.

Stochastic peaks earlier: %K reaches ~96 around Jan 14–17, then starts falling sharply while price is still near/above previous highs.

This creates bearish divergence:

Price higher high (97 vs earlier 92–96)

Stochastic lower high (%K drops from ~96 → 74)

→ Early warning that buying pressure is exhausting.

Interpreting the stochastic indicator effectively requires understanding its behavior relative to price movements and other market indicators. Recognizing overarching patterns is essential in drawing actionable insights from data.

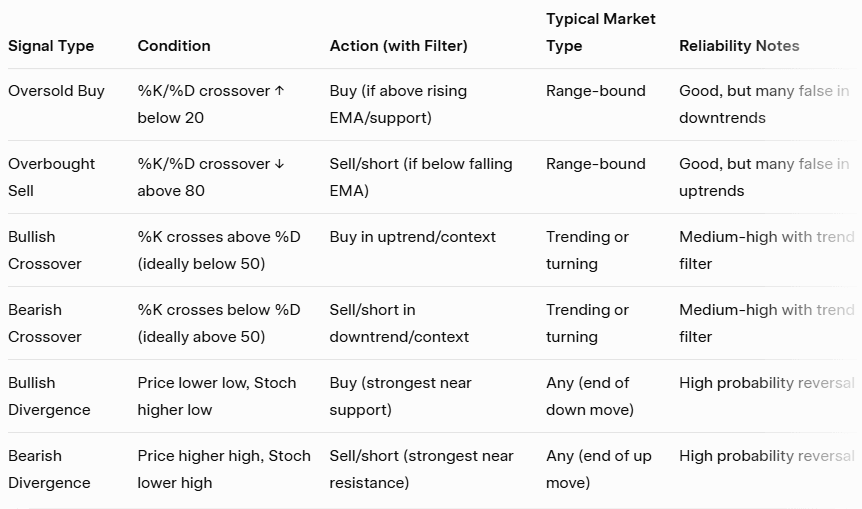

Traders should first become acquainted with the concepts of overbought and oversold levels. High readings above 80 necessitate caution, indicating that the price may revert downwards, while readings below 20 suggest that a reversal upwards could be imminent. However, these levels are not definitive sell or buy signals; rather, they serve as indicators that warrant further investigation.

Crossovers between the %K and %D lines also play a crucial role in reading the stochastic signals. A bullish signal occurs when the %K line crosses above the %D line in an oversold region, while a bearish signal manifests when the %K crosses below the %D line in an overbought region. These crossovers can prompt traders to take actionable positions, bolstering their trading strategy.

In addition to these signals, analyzing divergences between the stochastic oscillator and price can provide significant insights. Bullish divergence occurs when prices make a lower low while the oscillator creates a higher low, hinting at potential buying opportunities. Conversely, bearish divergence indicates that prices are making new highs, but the indicator shows diminished momentum, signaling potential selling positions.

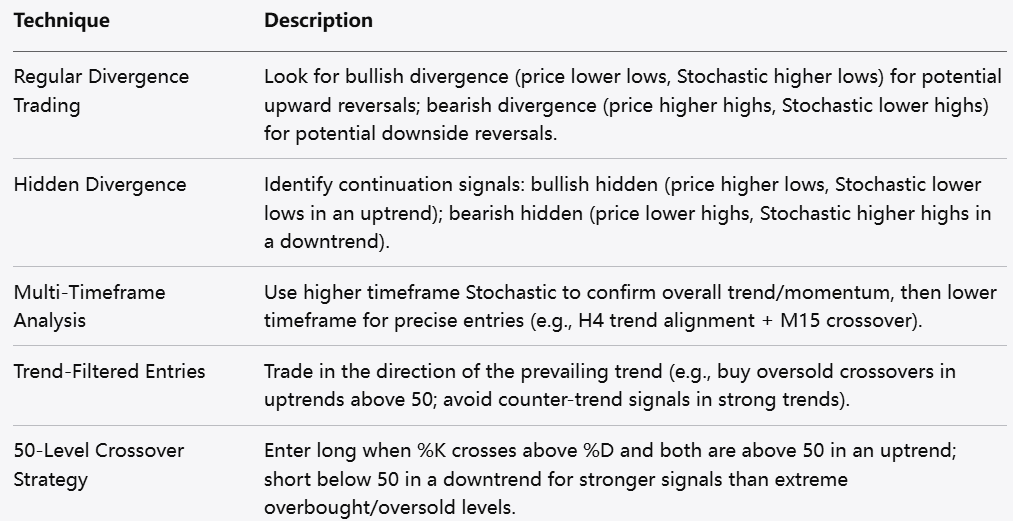

Utilizing the stochastic oscillator effectively requires a comprehensive understanding of its theoretical underpinnings and market behavior. Traders can explore several practical applications to enhance their trading strategies.

Overbought/Oversold Extremes (Mean-Reversion in Ranges)

Example: On a daily chart of a stock in a range between $50–$60:

Price drops to $51 (near support), Stochastic %K = 12, %D = 18 → %K crosses above %D → bullish signal.

Trader buys at $51.50 → price bounces to $58 → exit on overbought crossover near 85.

One of the primary applications involves using the oscillator to identify entry and exit points. For instance, a trader may decide to enter a long position when the %K line crosses above the %D line while the oscillator is below 20. This signal indicates that the price may be poised for a rebound.

Conversely, if the %K line crosses below the %D line above the 80 threshold, it could signal a sell opportunity. In both instances and throughout, traders must also consider risk management strategies to limit exposure and adjust positions according to their risk appetite.

Moreover, traders can refine their strategies by examining the characteristics of the specific asset being traded. The stochastic oscillator may behave differently across various asset classes, including equities, commodities, and currencies. Understanding these nuances allows traders to tailor their approach to market conditions, maximizing their potential for success.

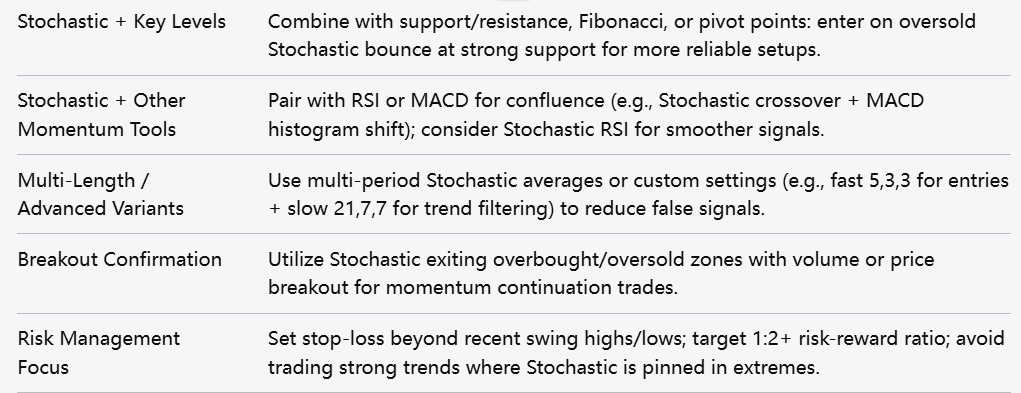

Integrating the stochastic oscillator with other technical indicators can significantly enhance its effectiveness and improve trading outcomes. Among the most commonly used complementary indicators is the Relative Strength Index (RSI). The RSI measures the speed and change of price movements and can help confirm signals produced by the stochastic oscillator.

When both indicators signal overbought or oversold conditions, this convergence strengthens the case for action. For instance, if the stochastic oscillator exceeds 80 while the RSI also surpasses 70, traders may feel confident in taking a short position, bolstered by an increase in confirmation from multiple indicators.

Additionally, employing moving averages can help smooth out price fluctuations and generate clearer signals. For example, combining the stochastic oscillator with a 50-day moving average can help traders identify trends while the oscillator provides timely entry and exit signals, improving their overall trading efficiency.

Rule:

In an uptrend (price above 50/200 EMA), only buy on Stochastic oversold crossovers or bullish divergences. Ignore sell signals.

In a downtrend (price below EMAs), only sell on overbought crossovers or bearish divergences. Ignore buy signals.

Popular setup: Stochastic (14,3,3) + 50-period EMA + 200-period EMA

→ Buy when price > 50 EMA > 200 EMA and %K crosses above %D below 50 (or from oversold).

This dramatically reduces whipsaws in trending markets.

Confluence rule:

Look for both in oversold/overbought at the same time → stronger reversal signal.

Divergences on both → very high-probability setups (rare but powerful).

Common tweak: Use Stochastic (14,3,3) + RSI (14) → buy when both exit oversold with crossovers.

Best signals:

Stochastic oversold crossover + MACD bullish crossover / histogram flip → strong buy.

Bearish divergence on Stochastic confirmed by MACD bearish crossover or declining histogram.

This combo catches momentum turns within trends very well.

Example:

Stochastic oversold + bullish engulfing/doji at strong support + %K/%D bullish crossover → high-conviction long.

Volume analysis is another valuable addition to the stochastic oscillator. Changes in trading volume can often precede price movements, helping traders bolster their predictions. High volume accompanying a crossover signal detects strength behind the move, increasing confidence in the trading decision.

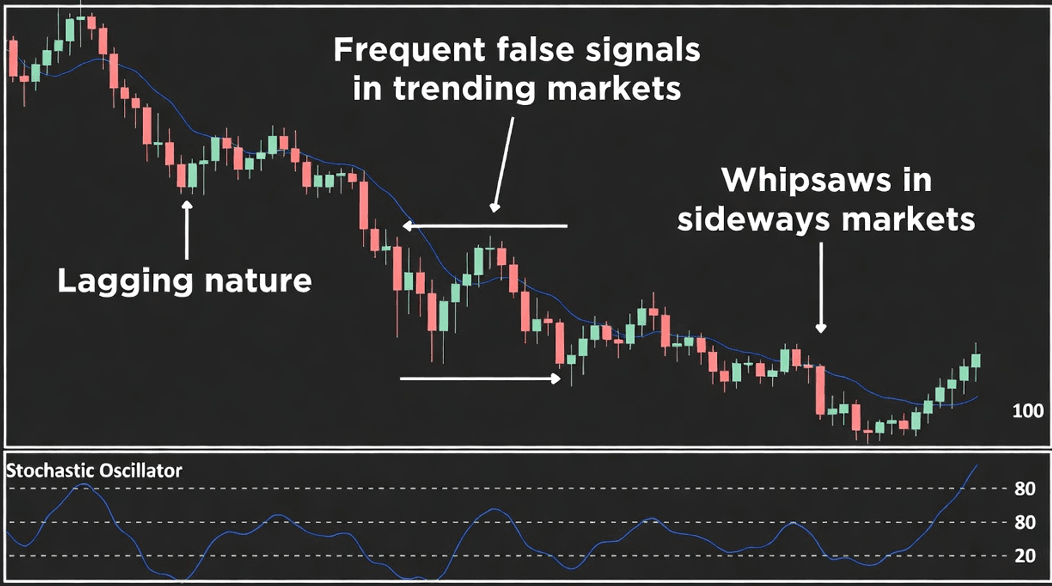

While the stochastic oscillator is an indispensable tool, it is essential to recognize its limitations. Overreliance on any single indicator can lead to misinterpretations and costly trades. Understanding the constraints of the stochastic oscillator equips traders to mitigate risks effectively.

One limitation is the potential for false signals, especially during strong trends. The indicator may remain in overbought or oversold territory for extended periods, misleading traders into thinking a reversal is imminent. For this reason, traders should always seek confirmation before making decisions based on stochastic signals alone.

Another crucial consideration is time sensitivity. The effectiveness of the stochastic oscillator can differ according to the timeframe utilized. Shorter timeframes might yield more frequent trading signals, but they often present greater market noise, making it challenging for traders to discern genuine opportunities.

Market conditions also significantly impact the performance of the stochastic oscillator. In highly volatile or low-volume environments, oscillator signals may become less reliable, leading to suboptimal decisions. Thus, staying attuned to broader market dynamics is essential in determining when to rely on the stochastic oscillator effectively.

For traders eager to maximize the potential of the stochastic oscillator, implementing advanced trading techniques can provide a competitive edge. Multi-timeframe analysis is one such approach, enabling traders to view price action across different time intervals to strengthen their trading decisions. By analyzing the stochastic oscillator over longer timeframes while executing trades on shorter ones, traders can identify overarching trends while pinpointing optimal entry and exit points.

Customizing threshold levels is another technique that savvy traders might consider. Rather than adhering to the established levels of 20 and 80, traders could adjust these thresholds based on the unique characteristics of the asset and prevailing market conditions. This adaptive strategy allows traders to capture more high-probability price movements while reducing reliance on rigid limits.

Integrative approaches such as combining the stochastic oscillator with other indicators can also enhance predictive accuracy. For instance, employing Bollinger Bands alongside the stochastic oscillator can provide invaluable insights into potential price reversals in the context of volatility. When prices touch the upper band and the stochastic oscillator indicates overbought conditions, the likelihood of a price correction increases, offering traders a strategic opportunity to short.

Furthermore, backtesting is a crucial aspect of refining trading strategies rooted in the stochastic oscillator. Traders can use historical price data to simulate how the indicator would have performed under various market conditions, helping them optimize their entry and exit strategies.

Lastly, practicing diligent risk management is paramount. Establishing stop-loss orders protect against significant losses while setting profit targets aligns with responsible trading practices. By maintaining a fixed risk-reward ratio—such as 1:2 or 1:3—traders can ensure that potential gains outweigh losses.

To further illustrate the practical utility of the stochastic oscillator, let us delve into real-world examples. Taking a well-known stock like Apple Inc. as a case study, we can track instances where the stochastic oscillator has provided critical signals.

Imagine observing a period where Apple’s stock price rises sharply, causing the stochastic oscillator’s %K line to break above the 80 level. During this time, a trader might note this as a potential overbought condition, prompting them to observe for a crossover with the %D line. Should the %K line subsequently cross below the %D, it could signal a prime opportunity to sell.

Conversely, during a downturn, if Apple’s stock price declines, causing the stochastic oscillator to drop below the 20 level, a trader might interpret this as an oversold condition. If the %K line crosses over the %D line in this region, it may present an enticing buy signal, suggesting a rebound might be imminent.

Another practical application involves commodities such as crude oil. In a volatile trading environment driven by geopolitical tensions, oil prices can oscillate rapidly. Traders could leverage the stochastic oscillator to identify short-term trading opportunities during high volatility periods when false breakouts might abound. Understanding when to rely on the oscillator alongside monitoring global events provides traders with a more nuanced approach.

In summary, the stochastic indicator is a powerful tool in the arsenal of traders and technical analysts, providing insights into momentum and potential market reversals. By mastering its formula, behavior, and application strategies, traders can significantly improve their decision-making process.

Moreover, the stochastic oscillator's integration with other indicators, such as the RSI and volume analysis, can bolster its efficacy, enhancing a trader's overall success in navigating ever-changing market conditions.

Awareness of the stochastic oscillator's limitations ensures that traders remain grounded and cautious, avoiding overreliance on any single tool. When combined with advanced trading techniques, such as backtesting, multi-timeframe analysis, and effective risk management, traders can elevate their trading strategies, improving their chances of capitalizing on market movements.

Ultimately, when utilized with diligence and complemented by sound trading practices, the stochastic oscillator can be instrumental in guiding traders toward more informed, confident, and profitable trading decisions.

Looking to trade stock CFDs? Choose Markets.com for a user-friendly platform, competitive spreads, and a wide range of assets. Take control of your trading journey today! Sign up now and unlock the tools and resources you need to succeed in the exciting world of CFDs. Start trading!

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.