Access Restricted for EU Residents

You are attempting to access a website operated by an entity not regulated in the EU. Products and services on this website do not comply with EU laws or ESMA investor-protection standards.

As an EU resident, you cannot proceed to the offshore website.

Please continue on the EU-regulated website to ensure full regulatory protection.

Thursday Nov 13 2025 10:08

14 min

WTI crude oil price today: West Texas Intermediate (WTI) crude oil is one of the primary benchmarks for crude oil pricing globally.

Crude oil trading: Known for its high quality and low sulfur content, WTI is a light sweet crude oil extracted from oil fields in the United States, primarily Texas. The price of WTI crude oil plays a critical role in the global energy market and is closely watched by traders, investors, analysts, and policymakers worldwide.

WTI crude oil prices are influenced by a complex interplay of factors including supply-demand dynamics, geopolitical events, economic data, technological advances, and environmental policies. Understanding the current price movement of WTI crude oil is essential for market participants who want to capitalize on opportunities or hedge risks in energy markets.

This article explores the current price environment of WTI crude oil, analyzes price targets, and explains how traders can participate in the oil market through Contracts for Difference (CFDs) on platforms such as Markets.com.

Supply and Demand Fundamentals

The price of WTI crude oil today reflects the ongoing balance — or imbalance — between supply and demand. Major producers, including the United States, Saudi Arabia, Russia, and OPEC member countries, influence supply levels through production quotas and policies. On the demand side, consumption from industrial sectors, transportation, and power generation drives the need for crude oil.

In recent years, factors such as economic growth projections, pandemic recovery, and technological shifts toward renewable energy have altered the demand landscape. For example, an economic slowdown in major countries can reduce oil consumption, while a robust recovery can push prices higher.

Geopolitical Influences

Geopolitical tensions in oil-producing regions significantly affect WTI crude oil prices. Conflicts, sanctions, and diplomatic negotiations can disrupt supply chains and create uncertainty, often resulting in price volatility. Events in the Middle East, Venezuela, and Russia have historically impacted oil prices, and traders closely monitor news flow to anticipate price movements.

Inventory Reports and Market Sentiment

Weekly inventory reports published by agencies such as the U.S. Energy Information Administration (EIA) provide insights into stockpiles of crude oil and refined products. An unexpected build in inventories can signal weaker demand or oversupply, pushing prices down. Conversely, draws in inventory may indicate tightening supply and support rising prices.

Market sentiment, driven by technical analysis, speculative positioning, and broader economic indicators, also plays a role in day-to-day WTI crude oil price fluctuations.

source: tradingview

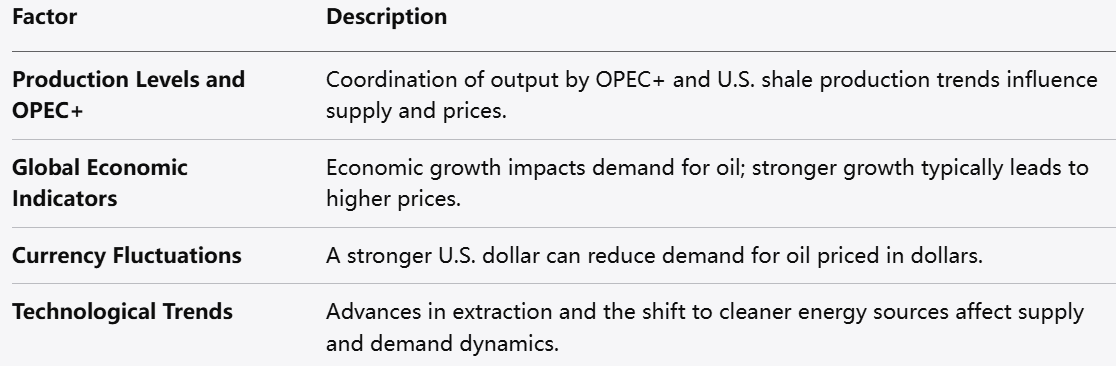

Production Levels and OPEC+

The Organization of the Petroleum Exporting Countries (OPEC), along with allied producers like Russia (collectively known as OPEC+), plays a pivotal role in setting production targets. By coordinating output, OPEC+ aims to stabilize markets and manage price levels. Decisions to cut or increase production typically send immediate signals to the market and affect WTI prices.

U.S. shale oil production is another critical factor. Advances in hydraulic fracturing and horizontal drilling have allowed the United States to become a leading oil producer. Changes in drilling activity, rig counts, and capital expenditures influence supply levels domestically.

Global Economic Indicators

Economic growth data such as GDP, manufacturing output, and consumer spending impact oil demand forecasts. Strong economic performance usually correlates with increased energy consumption, supporting higher prices. Conversely, recessions or slowdowns reduce demand expectations, weighing on crude oil prices.

Currency fluctuations, particularly the strength of the U.S. dollar, also matter. Since oil is globally priced in U.S. dollars, a stronger dollar makes crude oil more expensive for holders of other currencies, potentially dampening demand.

Technological and Environmental Trends

The transition toward cleaner energy sources and implementation of environmental regulations affect long-term crude oil demand. Electric vehicles, renewable energy investments, and carbon reduction commitments are gradually reshaping the energy market and influencing price expectations.

Technological improvements in oil extraction and refining can reduce costs, impacting supply dynamics and market competition.

Short-Term Price Projections

Short-term WTI crude oil price targets depend heavily on immediate supply-demand conditions, inventory data, and geopolitical developments. Analysts often use technical analysis tools such as moving averages, support and resistance levels, and momentum indicators to estimate near-term price ranges.

For example, a recent upward momentum might suggest a target level near previous highs, while a breakdown below key support levels could indicate further downside risk.

Medium to Long-Term Outlook

Medium and long-term price targets incorporate fundamental trends such as global economic growth forecasts, investment in production capacity, and energy transition policies. Many analysts provide price ranges based on scenarios including continued economic expansion, aggressive clean energy adoption, or unexpected supply disruptions.

Investors should consider multiple scenarios and remain flexible, as oil prices can be volatile and sensitive to sudden changes in market conditions.

Key Resistance and Support Levels

Technical traders identify critical resistance and support price points on WTI crude oil charts. Resistance levels indicate price ceilings where selling pressure might increase, while support levels mark floors where buying interest tends to appear.

Monitoring these levels helps traders set entry and exit points, stop losses, and profit targets.

What Are CFDs?

Contracts for Difference (CFDs) are financial instruments that allow traders to speculate on price movements of underlying assets without owning the physical commodity. With oil CFDs, traders can profit from both rising and falling prices of WTI crude oil.

CFD trading involves entering a contract with a broker that pays the difference between the opening and closing prices of the contract.

Advantages of Trading Oil CFDs

Risks to Consider When Trading Oil CFDs

While CFDs offer flexibility and leverage, they also carry risks. Leverage magnifies losses as well as gains, so risk management strategies such as stop-loss orders and position sizing are essential. Volatility in oil prices can result in rapid changes, requiring close monitoring.

Markets.com provides a user-friendly interface, educational resources, and customer support to assist traders at all levels.

Popular Indicators for Oil Trading

Technical traders use various indicators to analyze price trends and momentum in WTI crude oil, including:

Chart Patterns

Recognizing chart patterns such as head and shoulders, triangles, flags, and double tops/bottoms can provide clues about future price movements and help traders set targets.

Volume Analysis

Volume provides insight into the strength of price moves. High volume during price advances or declines confirms momentum, while low volume may signal weak trends.

Monitoring Economic Data

Economic calendars highlight key data releases that impact oil prices, such as:

Geopolitical Events

Keep informed on geopolitical developments including:

Trend Following

This strategy involves identifying and trading in the direction of prevailing price trends, using moving averages or trendlines to confirm.

Range Trading

When prices consolidate between support and resistance levels, traders buy near support and sell near resistance, taking advantage of predictable price swings.

Breakout Trading

Traders watch for price breaks above resistance or below support with increased volume, entering positions to capture the momentum.

News-Based Trading

Reacting swiftly to market-moving news releases and geopolitical events can create profitable opportunities, though it requires experience and discipline.

Position Sizing

Determine how much capital to allocate per trade to avoid excessive losses.

Stop-Loss Orders

Automatically close a trade when the price moves against you beyond a certain threshold.

Take-Profit Orders

Lock in gains by closing positions at predetermined profit levels.

Diversification

Avoid concentrating all capital in oil CFDs alone; consider diversifying across assets.

WTI crude oil remains a vital and dynamic component of the global energy market. Its price today reflects a complex array of factors from supply-demand fundamentals to geopolitical risks and economic trends. Setting realistic price targets requires both technical and fundamental insight.

Trading oil CFDs on platforms like Markets.com offers an accessible and flexible way to participate in this market, but it demands careful analysis, disciplined risk management, and ongoing market awareness.

By combining education, strategic planning, and the right tools, traders and investors can effectively navigate the opportunities and challenges presented by WTI crude oil.

1. WTI Crude Oil

West Texas Intermediate crude oil, a high-quality, light sweet crude oil benchmark primarily produced in the U.S.

2. CFD (Contract for Difference)

A financial derivative allowing traders to speculate on price movements of assets without owning the underlying commodity.

3. Leverage

Using borrowed capital to increase the potential return on investment, which also increases risk.

4. Long Position

Buying a CFD expecting the price of the underlying asset to rise.

5. Short Position

Selling a CFD expecting the price of the underlying asset to fall.

6. Stop-Loss Order

An order placed to automatically close a position at a specific price to limit losses.

7. Take-Profit Order

An order placed to automatically close a position when it reaches a specified profit level.

8. Support Level

A price point where demand is strong enough to prevent the price from falling further.

9. Resistance Level

A price point where selling pressure is strong enough to prevent the price from rising further.

10. Volatility

The degree of variation in trading prices over time, indicating market uncertainty or momentum.

Looking to trade oil CFDs? Choose Markets.com for a user-friendly platform, competitive spreads, and a wide range of assets. Take control of your trading journey today! Sign up now and unlock the tools and resources you need to succeed in the exciting world of CFDs. Start trading!

Q1: What influences WTI crude oil prices the most?

A: Prices are influenced by supply-demand balance, production decisions by OPEC+, U.S. shale output, geopolitical events, global economic indicators, and inventory reports.

Q2: Why trade WTI crude oil CFDs instead of physical oil?

A: CFDs allow trading with smaller capital, offer leverage, enable speculation on price declines, and avoid complexities of physical delivery and storage.

Q3: What are the risks of trading oil CFDs?

A: Risks include market volatility, leverage amplification of losses, and potential for rapid price swings due to geopolitical or economic news.

Q4: How much capital do I need to start trading WTI oil CFDs on Markets.com?

A: Minimum deposit requirements vary; check Markets.com for current terms. Use leverage carefully and start with amounts you can afford to lose.

Q5: Can I trade WTI crude oil CFDs 24/7?

A: Oil CFDs generally have trading hours aligned with global markets, typically Monday to Friday, but some brokers offer extended hours. Confirm on your platform.

Q6: How do I manage risk effectively when trading oil CFDs?

A: Use stop-loss orders, position sizing, diversify your portfolio, and avoid over-leveraging.

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.