Access Restricted for EU Residents

You are attempting to access a website operated by an entity not regulated in the EU. Products and services on this website do not comply with EU laws or ESMA investor-protection standards.

As an EU resident, you cannot proceed to the offshore website.

Please continue on the EU-regulated website to ensure full regulatory protection.

Wednesday Nov 12 2025 09:57

12 min

WTI trades at $60.75: West Texas Intermediate (WTI) crude oil is a key benchmark for oil prices in the United States and plays a significant role in global energy markets.

Best way to invest in WTI oil: Understanding what influences WTI oil prices is crucial for traders, businesses, policymakers, and consumers. This comprehensive exploration examines various factors affecting WTI oil prices, including market dynamics, geopolitical influences, supply and demand fundamentals, and broader economic indicators.

What is WTI Crude Oil?

WTI crude oil is sourced primarily from the Permian Basin in Texas and is characterized as light and sweet due to its low density and sulfur content. These traits make it highly desirable for refining into gasoline and other products. WTI is a major benchmark against which other oil prices are measured, making it vital to the overall functioning of the energy market.

Importance of WTI in the Global Market

As a key energy resource, WTI influences fuel prices, economic conditions, and geopolitical relations. Its pricing impacts various sectors, including transportation, manufacturing, and agriculture. Furthermore, WTI serves as a critical indicator for understanding oil market dynamics, making it essential to grasp the factors that drive its price movements.

1. Supply and Demand Dynamics

2. Geopolitical Factors

3. Economic Indicators

source: tradingview

Trading Practices

Speculative trading often plays a significant role in oil price movements. Traders and institutions buy and sell oil contracts based on their expectations of future price changes. Speculative activities can lead to heightened volatility, with traders reacting to news, reports, and economic data as they seek to capitalize on market movements.

Influence of Hedge Funds

Hedge funds and institutional investors often engage in oil trading based on their market outlooks. Their collective positioning in the market can amplify price movements, as large trades can lead to significant fluctuations in supply and demand dynamics.

Advances in Extraction Technologies

Technological advancements in oil extraction and production have transformed the industry. The U.S. shale revolution, driven by improved techniques such as hydraulic fracturing, has increased production capabilities and altered global supply dynamics. These advancements can impact WTI prices, particularly when supply exceeds demand.

Renewable Energy Technologies

The rise of renewable energy technologies is reshaping the energy landscape. As alternative energy sources become more viable and competitive, long-term demand for fossil fuels, including crude oil, may be affected. Market participants closely watch developments in renewables, as these trends can signal shifts in future oil demand.

Weather events and natural disasters can disrupt oil production and transportation. Hurricanes, for instance, can affect oil rigs and refineries in the Gulf of Mexico, leading to temporary supply constraints and influencing prices. Additionally, extreme weather conditions can impact transportation routes, affecting oil distribution and availability.

Oil is primarily traded in U.S. dollars, making currency fluctuations an important aspect of WTI pricing. A weaker dollar generally makes oil cheaper for holders of other currencies, potentially increasing demand. Conversely, a stronger dollar can lead to decreased demand as oil becomes more expensive in foreign markets.

Trading WTI oil involves several methods, including futures contracts, options, and exchange-traded funds (ETFs). Each approach offers different levels of risk and opportunity for participants in the oil market. Understanding these strategies is crucial for anyone looking to engage in WTI trading.

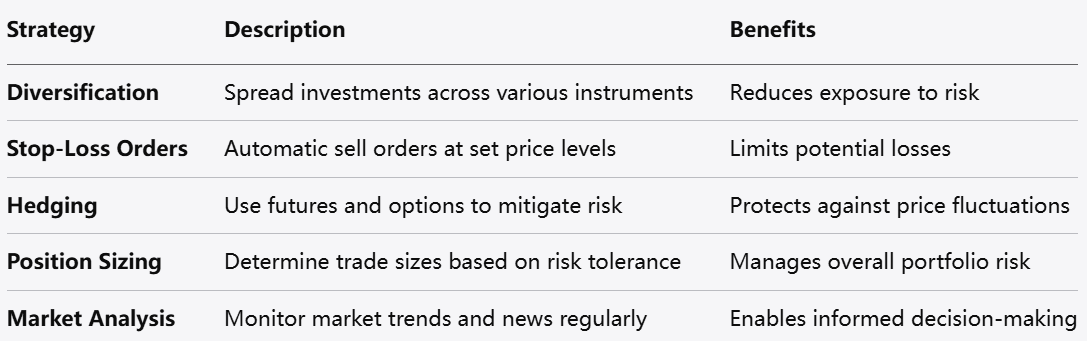

Effective risk management is critical in oil trading due to the market's inherent volatility. Traders often employ various strategies to mitigate risks:

Diversification: Spreading investments across different instruments or markets can reduce exposure to any single asset's price fluctuations.

Stop-Loss Orders: Setting stop-loss orders can protect against significant losses by automatically selling positions once they reach a predetermined price.

Hedging: Using futures contracts and options can help offset potential losses in physical holdings or long positions.

While predicting exact future prices for WTI is inherently uncertain, several trends and factors may influence its trajectory:

1. Continued Economic Recovery

As global economies recover, there is potential for increased demand for crude oil. Economic growth in emerging markets, particularly in Asia, could drive further consumption, influencing WTI prices positively.

2. Geopolitical Developments

Ongoing geopolitical tensions, particularly in oil-rich regions or related to major producers, will continue to create price fluctuations. Traders must stay attuned to these developments as they unfold.

3. Environmental Policies and Regulation

The transition towards sustainable energy practices may reshape the demand for fossil fuels. Stricter environmental regulations could impact drilling and extraction practices, influencing future supply.

4. Technological Trends

Advancements in extraction technology and increasing reliance on renewable energy sources will play pivotal roles in shaping future dynamics in the oil market.

Understanding the complexities of WTI oil prices requires a multifaceted approach that takes into account supply and demand factors, geopolitical influences, economic indicators, and technological advancements. As a key component of the global economy, fluctuations in WTI prices can have wide-ranging implications for various sectors.

For traders, businesses, and consumers alike, being informed about the factors affecting WTI prices is essential for making well-informed decisions. As the landscape continues to evolve, staying engaged with market developments will be crucial in navigating the dynamic world of crude oil trading.

Looking to trade oil CFDs? Choose Markets.com for a user-friendly platform, competitive spreads, and a wide range of assets. Take control of your trading journey today! Sign up now and unlock the tools and resources you need to succeed in the exciting world of CFDs. Start trading!

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.